Goldstone Securities is a multi-asset financial trading platform that claims to offer secure, transparent, and advanced solutions for global traders. Its products include forex, stocks, futures, commodities, indices, and cryptocurrencies, emphasizing personalized customer support, segregated account management, technical analysis services, and a 24/7 multi-device trading experience. The platform caters to both novice and professional traders, with various account levels and educational resources, aiming to create a one-stop trading environment. However, based on its registration information, regulatory status, and user base, there are significant concerns about its compliance and operational activity.

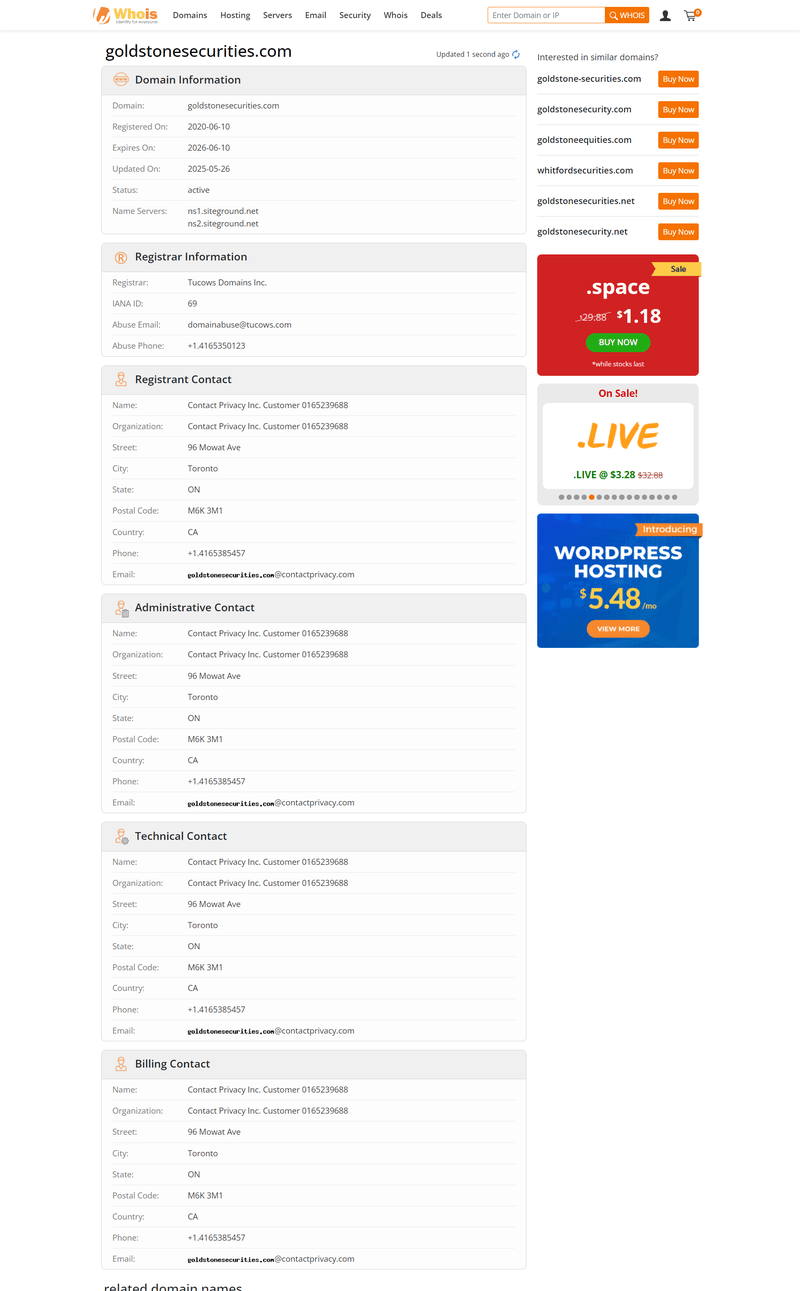

Website Registration Date

According to information from Whois, the domain goldstonesecurities.com was registered on June 10, 2020, and updated on May 26, 2025, with validity until June 10, 2026. Although the platform has existed for over four years, its brand presence, regulatory registration, and actual business activity do not align, necessitating further verification of its authenticity and operational status.

Trading Instruments

Goldstone Securities offers six major categories of financial asset trading products:

- Stocks: Covering 200+ globally renowned exchange-listed companies, including NYSE, NASDAQ, and LSE;

- Forex: Over 100 currency pairs with low spreads, emphasizing high liquidity and fast execution;

- Futures: Supports trading of commodity and index futures contracts;

- Indices: Includes major global indices such as S&P500, DAX40, FTSE100;

- Commodities: Covers crude oil, natural gas, gold, silver, wheat, corn, etc.;

- Cryptocurrencies: Provides CFD trading services for Bitcoin, Ethereum, and others.

The product line is broad, covering popular trading targets suitable for multi-strategy investors.

Trading Platform

The platform uses its proprietary system Goldstone Trader, featuring an intuitive interface, comprehensive functionality supporting one-click trading, chart analysis, and multi-device access. While it accommodates the trading habits of both novice and experienced traders, there are currently no detailed explanations of its platform security mechanisms, execution engine, or historical data performance reports. It is also unclear if it is based on industry-standard architecture like MT4/MT5, indicating a lack of transparency in the trading system.

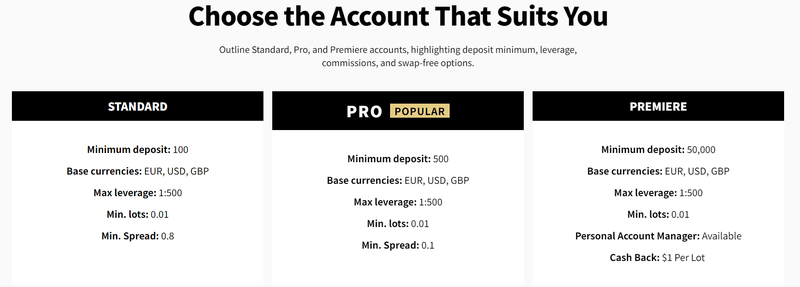

Account Types

Goldstone Securities offers three types of accounts:

- STANDARD: Minimum deposit of $100, minimum spread of 0.8, with leverage up to 1:500;

- PRO (labeled as POPULAR): Minimum deposit of $500, spreads as low as 0.1, with other parameters being the same;

- PREMIERE: Minimum deposit of $50,000, with a dedicated account manager and a $1 rebate per lot traded.

The account tiers are clear, catering to users with different capital sizes and service needs, although the high entry threshold for premium accounts may pose financial inducement risks for some users.

Agency Policy

Goldstone Securities has a multi-level agency cooperation scheme:

- IB Partner Program: Users can earn trading commissions by referring clients, with a transparent commission structure, no referral or trading volume limits;

- MAM/PAMM Fund Manager Program: Allows strategy creation and client fund management separation, with the platform providing technical support;

- Regional Representative Program: Suitable for local market expansion, with the platform offering brand, technical, and operational support, allowing agents to focus on promotion and client acquisition.

This cooperation structure is relatively complete, encouraging market promotion, but risk assessments should consider the platform's legality.

Regulatory Information

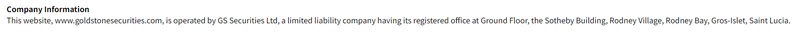

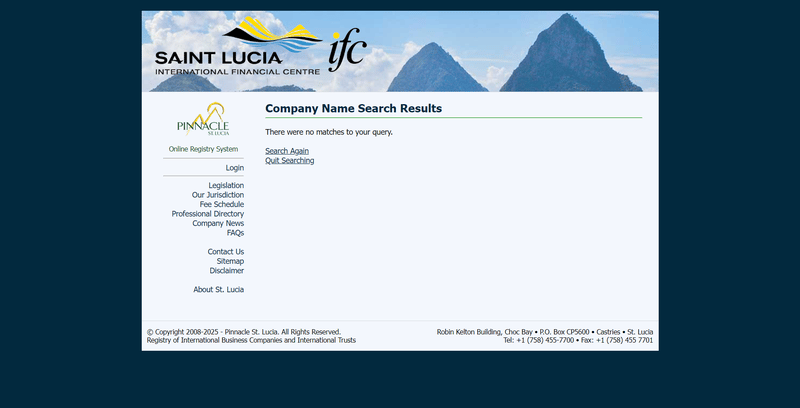

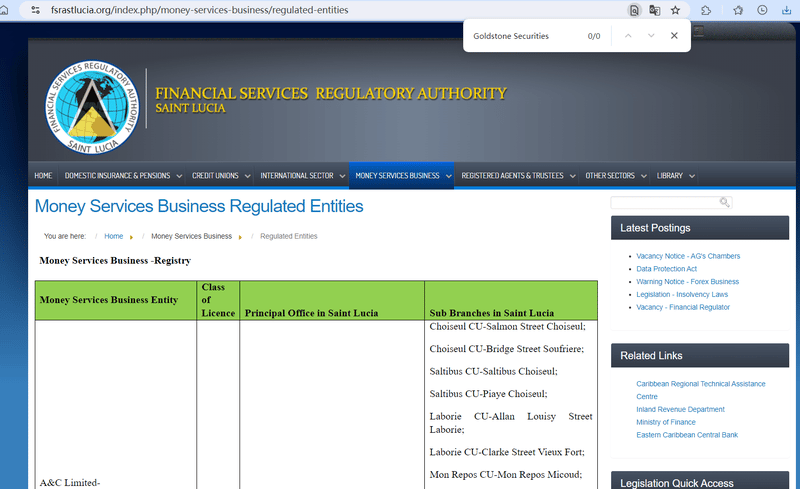

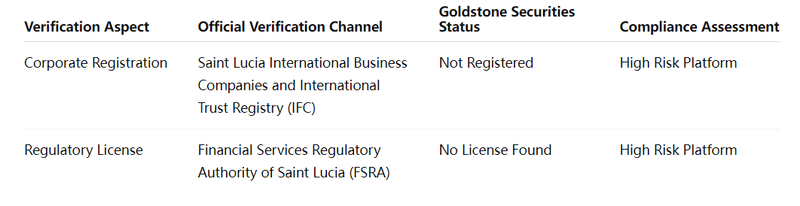

Goldstone Securities is operated by "GS Securities Ltd," with a registered address in the Rodney Bay area of Saint Lucia. Checking the Saint Lucia International Business Companies and International Trust Registry and the Saint Lucia Financial Services Regulatory Authority (FSRA), no valid registration record or regulatory authorization is found, indicating that the platform is currently unregulated with serious compliance risks.

Contact Information

The platform provides contact information such as the UK phone number +44(0) 20 4577 2286 and email [email protected]. Although the contact details are clear, there is no additional office photos, operational team information, or social interaction channels, lacking a sense of authenticity in building trust with users.

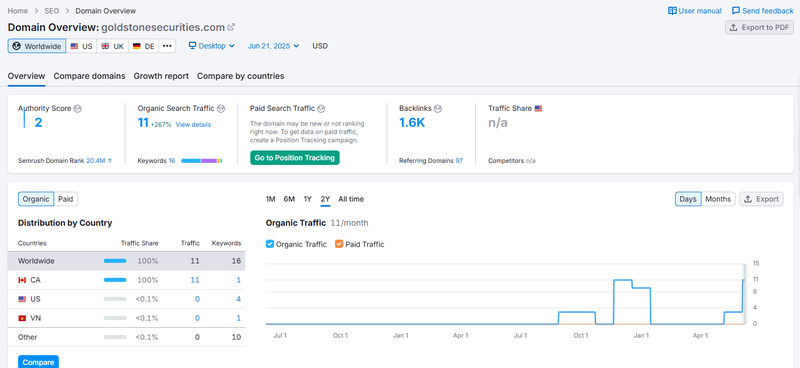

Website Traffic

According to data from Semrush, Goldstone Securities (website: https://goldstonesecurities.com/) has an average monthly visit of 1.6k, which is relatively low. The platform has not yet established a large-scale user base, and overall market activity is weak.

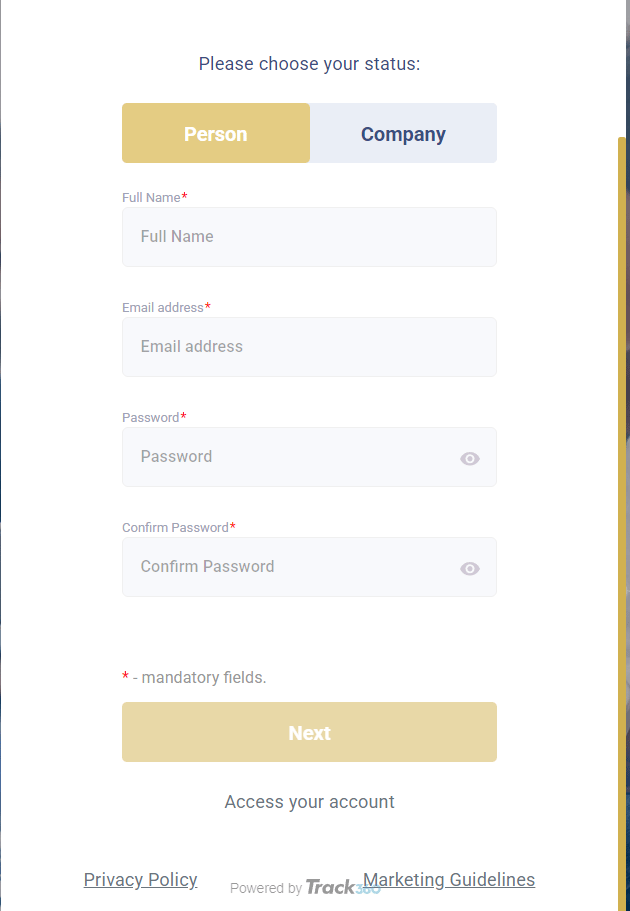

Registration Process Evaluation

- Website Interface Logic: Clear layout, well-defined content categories, and reasonable navigation hierarchy.

- Registration Form Content: Simple and intuitive design with reasonable field settings, supporting error prompts to aid completion.

- Education Resources Evaluation: Goldstone Securities provides basic financial knowledge texts, but the educational depth is insufficient with a lack of interactivity, making it difficult to support systematic user growth.

- Social Media: The platform has not established any social media accounts, lacking interaction and communication channels with users, resulting in low brand transparency.

Platform Authenticity Self-Check

- Verification of Entity Information: Visit Saint Lucia IFC website → Enter registered address → Compare company name

- Verification of Regulatory Information: Visit FSRA website → Enter company name → Search financial license records

- Domain Tenure Verification: Visit whois.com → Enter domain name → Check registration time and verify promotional consistency

Signals Users Should Be Wary Of

- Mismatched promotional time and registration records

- Lack of regulatory number and actual license

- Limited website information with low transparency

- Superficial educational content, difficult to support actual trading capability development

- Complete absence of social media presence

TraderKnows Dual Verification Form for Regulatory Registration

Conclusion

Pros

- Diverse trading product line covering global popular asset classes

- Flexible account structure catering to different capital and service needs

- Simple registration process and good interface design

- Basic educational section beneficial for entry-level learning

- Multiple funding and withdrawal methods, supporting both cryptocurrency and traditional channels

- Rich variety of partnership types, complete promotion mechanism

Cons

- No registration information in Saint Lucia, lacking regulatory approval

- Inconsistency between operational history and domain registration time

- Superficial educational content, lacking deep learning support

- Lack of social media and brand interaction channels

- Low website traffic, lack of real user engagement

- Insufficient disclosure of platform technical information, transparency needs improvement

As a platform offering multi-asset trading services, Goldstone Securities demonstrates certain advantages in account design, product coverage, and interface experience, attracting to beginner users. However, there are several deficiencies in regulatory credentials, platform compliance, educational support, and market activity. For investors, the platform lacks a full trust foundation, and a full understanding of risks is advisable before using it.

Disclaimer: The content of this article is based on publicly available information and platform testing experience, and the actual effect may vary depending on market conditions.