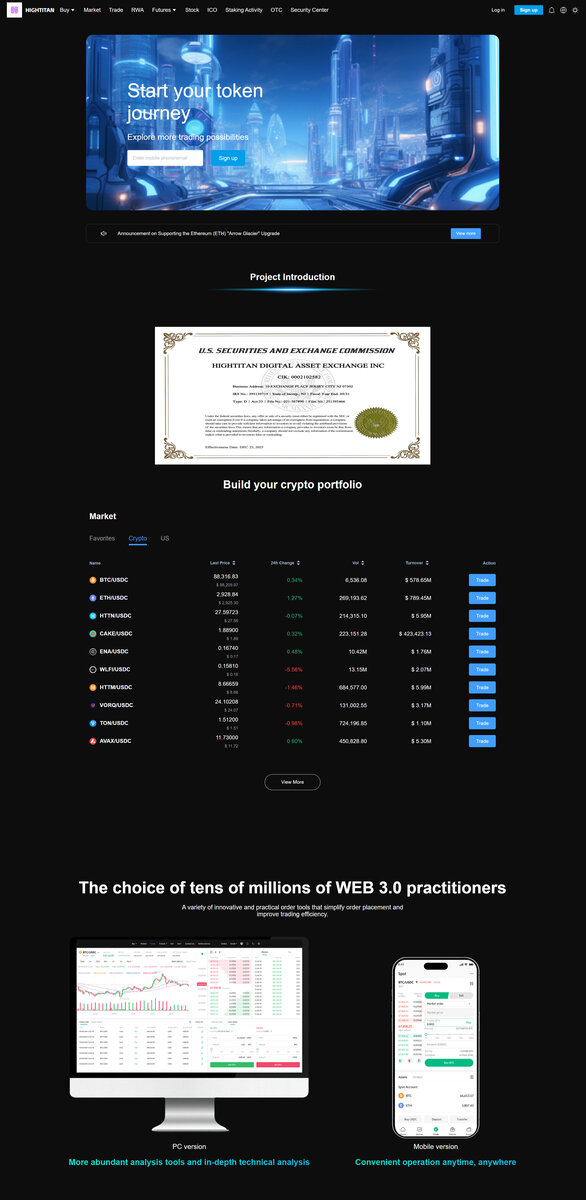

HIGHTITAN Trading Center is a U.S.-based digital asset platform that combines funding, trading, and education in one integrated workspace. From a regulated U.S. base, it serves global users with spot markets, fiat on-ramps, derivatives tools, and selective ICO access. The platform emphasizes transparent operations, robust security, and long-term investor education rather than short-term speculation.

Company Background

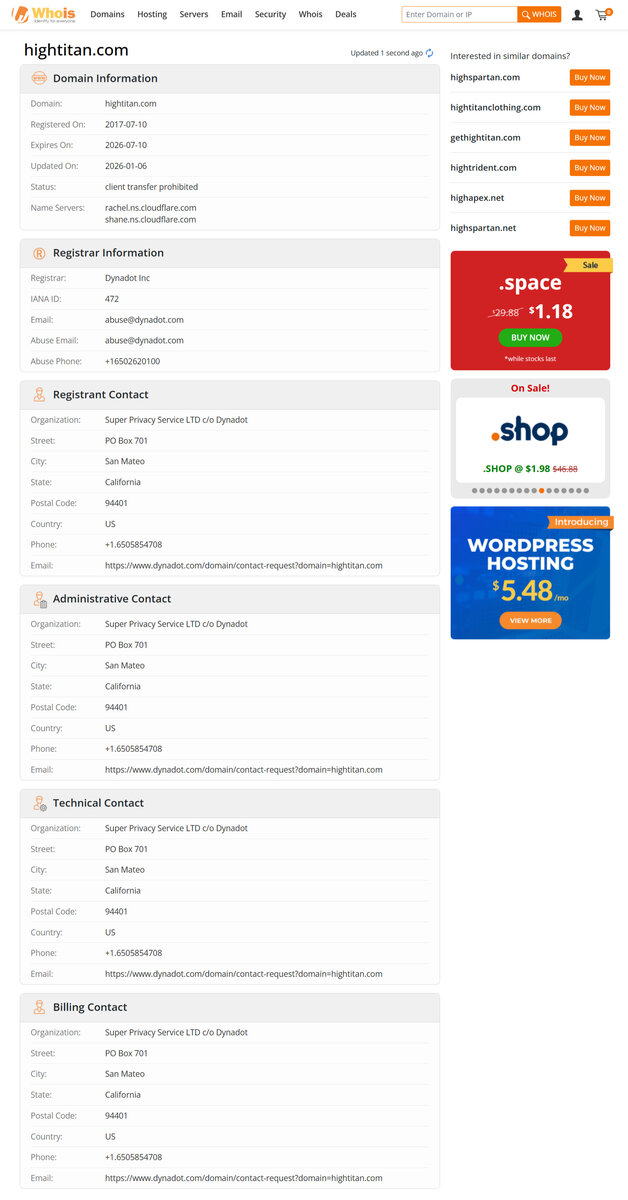

Founded in 2017 and headquartered in Jersey City, New Jersey, HIGHTITAN Trading Center has maintained continuous operation through multiple market cycles. The company operates as a Money Services Business (MSB) registered with the U.S. Financial Crimes Enforcement Network (FinCEN), bringing its activities under federal Anti-Money Laundering (AML) and Know Your Customer (KYC) oversight and formal reporting requirements.

HIGHTITAN’s team combines internet product expertise with practical finance experience, building an environment where funding, trading, and learning coexist. Its H5 browser interface and mobile apps have supported live trading since August 2017, with infrastructure engineered to handle periods of high volatility and heavy order flow without sacrificing responsiveness or stability.

Services

- Spot trading for direct exposure to digital assets using a unified trading interface.

- Derivatives tools for strategic hedging and more advanced portfolio construction.

- Fiat on-ramps and deposit channels to move funds from traditional finance into the platform.

- Selective ICO participation for users who meet suitability and risk criteria.

- HIGHTITAN Academy with articles, videos, and webinars on markets, risk, and trading frameworks.

- 24/7 multilingual customer support to help resolve account, funding, and trading questions quickly.

Is Scam?

Available evidence does not support the claim that HIGHTITAN Trading Center is a scam. The platform is registered with FinCEN as an MSB, which imposes obligations around AML, KYC, record keeping, and periodic reporting. These obligations create traceability for transactions and a regulatory framework that is inconsistent with anonymous or fraudulent operations.

In addition, the company has a documented operating history since 2017, structured beta programs, and a visible emphasis on education and risk understanding rather than unrealistic profit promises. Public information about its services, security practices, and support channels aligns with the profile of a compliant trading and education platform focused on long-term use.