CFOs Show Steady Optimism in Latest Economic Survey

A Grant Thornton survey finds 52% of CFOs are optimistic about the US economy, with steady views on business fundamentals and increased focus on digital investment.

A Grant Thornton survey finds 52% of CFOs are optimistic about the US economy, with steady views on business fundamentals and increased focus on digital investment.

Fenimore Asset Management released its Q4 2025 investor letter, detailing fund performance and discussing Trane Technologies as a key detractor, while noting AI stock trends.

Fenimore Asset Management released its Q4 2025 investor letter, detailing fund performance and commenting on AutoZone as a key detractor, while noting market volatility and AI stock trends.

Fenimore Asset Management released its Q4 2025 investor letter, detailing fund performance and citing Markel Group as a top performer in its value strategy.

Fenimore Asset Management released its Q4 2025 investor letter, detailing fund performance and citing Fastenal Company as a key detractor due to industrial sector weakness.

Polymarket's odds were displayed during the Golden Globes, correctly predicting 26 of 28 categories, as CEO Shayne Coplan noted on X.

Fenimore Asset Management released its Q4 2025 investor letter, detailing fund performance and commenting on market conditions and specific holdings like FirstService Corporation.

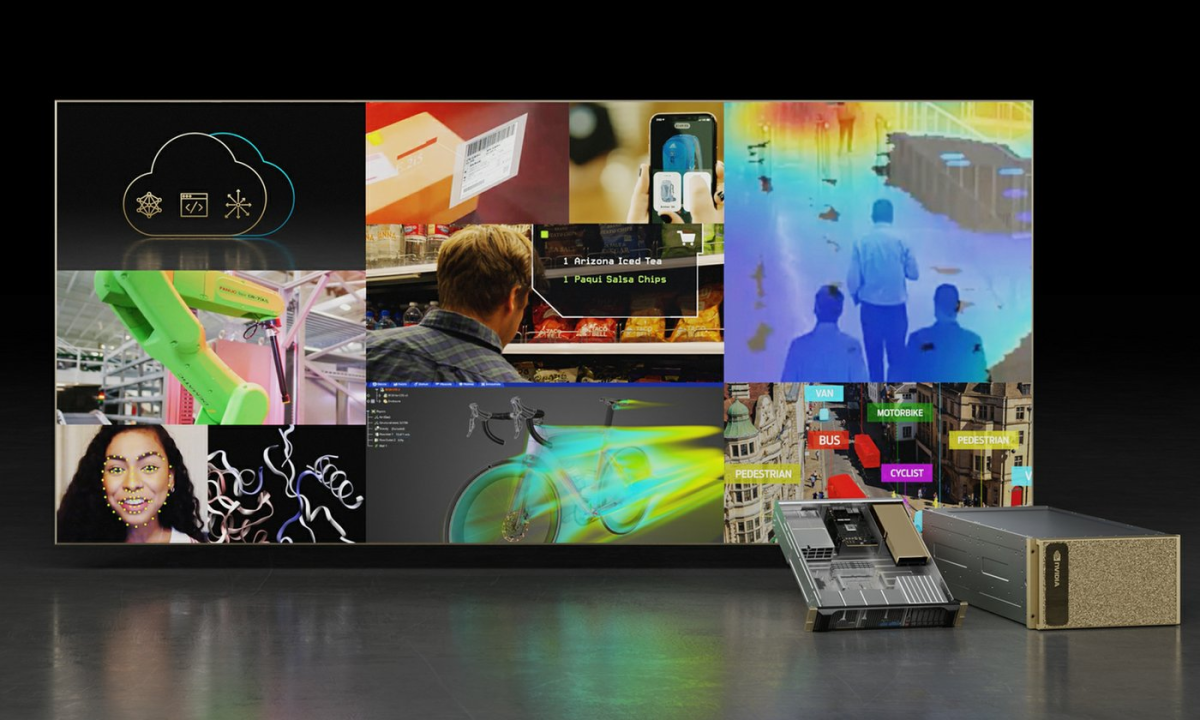

Nvidia and Eli Lilly announced a $1 billion joint research lab at the JPMorgan Healthcare Conference, aiming to accelerate drug discovery using AI. The five-year project will use Nvidia's latest chips.

Fenimore Asset Management released its Q4 2025 investor letter, detailing performance across strategies and highlighting Brown & Brown as a key detractor. The firm noted market volatility driven by AI enthusiasm and economic uncertainty.

A 1% federal tax on certain international money transfers began on Jan. 1, affecting cash, check, and money order remittances. Critics say it burdens working families, while supporters link it to immigration policy.

The NYSE and Nasdaq will observe 10 holidays and early closures in 2026, with schedules for 2025 and 2027 also detailed. Regular hours are 9:30 a.m. to 4 p.m. ET, Monday through Friday.

Egg Power, Liberty Global's clean energy arm, has secured up to £400 million from NatWest to develop solar and wind projects across Europe, aiming to support telecom and digital infrastructure growth.

Analysts from Telsey Advisory and RBC Capital reaffirmed outperform ratings for Albertsons Companies, citing upside potential and growth projections.

Stifel Nicolaus and Goldman Sachs analysts reiterated Buy ratings for McGraw Hill Inc. following a CEO change announcement, citing upside potential despite timing concerns.

Bernstein SocGen's Alexia Burland Howard reaffirmed a Buy rating on Simply Good Foods, raising the target price to $31, while Deutsche Bank's Stephen Powers maintained a Hold rating, lowering the target to $22.