Albemarle (NYSE: ALB), a lithium and bromine producer, has faced challenges in recent years due to a weaker-than-expected electric vehicle battery market. EV sales have disappointed, leading to falling lithium prices and market oversupply.

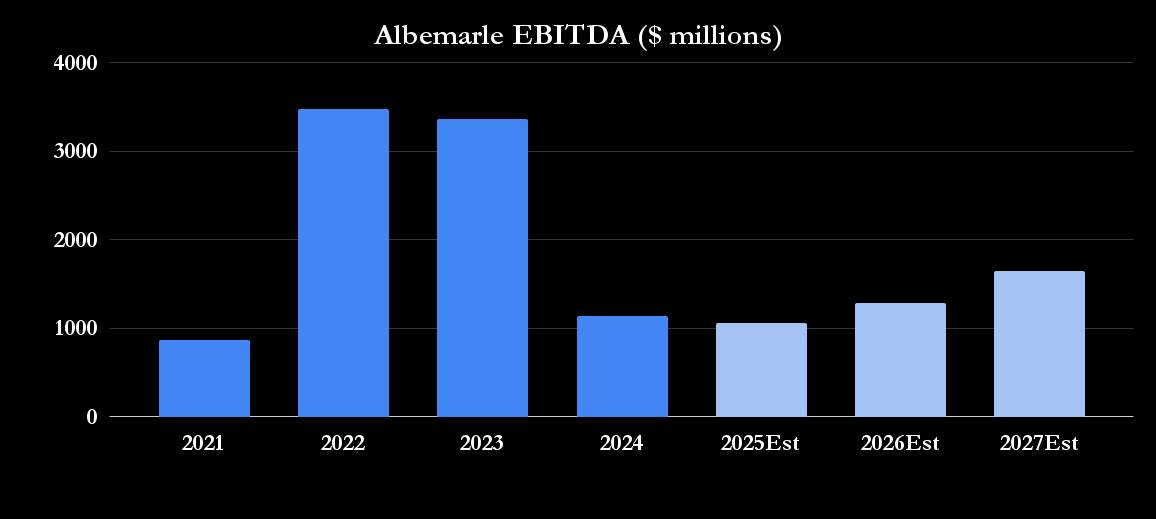

Analysts project a sharp earnings recovery for Albemarle in 2026, driven by an anticipated lithium market rebound. The company's management has refocused on core strategy after divesting stakes in refining catalyst and catalyst services businesses worth approximately $660 million.

Cost and productivity actions are expected to deliver $450 million in cost reductions, exceeding an initial target of $300 million to $400 million. These measures, along with cash-raising divestitures, are intended to enable Albemarle to invest in potential lithium production expansion while securing its balance sheet.

Lithium carbonate prices in China, a key driver of lithium demand, have increased by 51% over the last month and 85% over the last year. This movement is attributed to growing energy storage demand, data center demand, and large-scale battery demand. Albemarle's energy storage volumes have been better than expected in 2025.

Ongoing strength in the Chinese EV market and potential stabilization in U.S. and European EV battery investment support further lithium price improvement. The International Energy Agency expects a 40% lithium supply shortfall in 2035 under current policies.

Albemarle's divestitures have reduced some risk, but the growing importance of demand from China has increased exposure to spot market volatility. In 2025, about 50% of Albemarle's sales were at spot prices, compared to approximately 33% in 2024. This shift raises both downside risks and potential upside for earnings if lithium prices rise through 2026, driven by booming energy storage demand.

The Motley Fool Stock Advisor analyst team identified what they believe are the 10 best stocks for investors to buy now, and Albemarle was not among them. The team noted that the 10 selected stocks could produce significant returns in coming years.