On January 15, Citi maintained a Neutral rating on Advanced Micro Devices Inc. (NASDAQ: AMD) with a $260 price target. The firm noted that while the company's AI division is expanding, this growth is being dampened by muted margin leverage. Citi explained that the costs of scaling are currently preventing AI gains from significantly boosting overall profitability.

On January 14, RBC Capital initiated coverage of AMD with a Sector Perform rating and a $230 price target. The firm stated that the OpenAI deal proves AMD is a credible GPU supplier for hyperscale projects, but the stock's current valuation likely already accounts for expected initial ramps. RBC Capital sees few immediate catalysts for the stock until the MI450 ramps for OpenAI in the fourth quarter.

Earlier on January 5, Advanced Micro Devices launched the Ryzen AI Embedded family, a new series of x86 processors designed specifically for edge AI applications. The portfolio introduces the P100 and X100 Series, which target sectors requiring high-performance computing in compact environments, such as automotive digital cockpits, industrial automation, smart healthcare, and humanoid robotics.

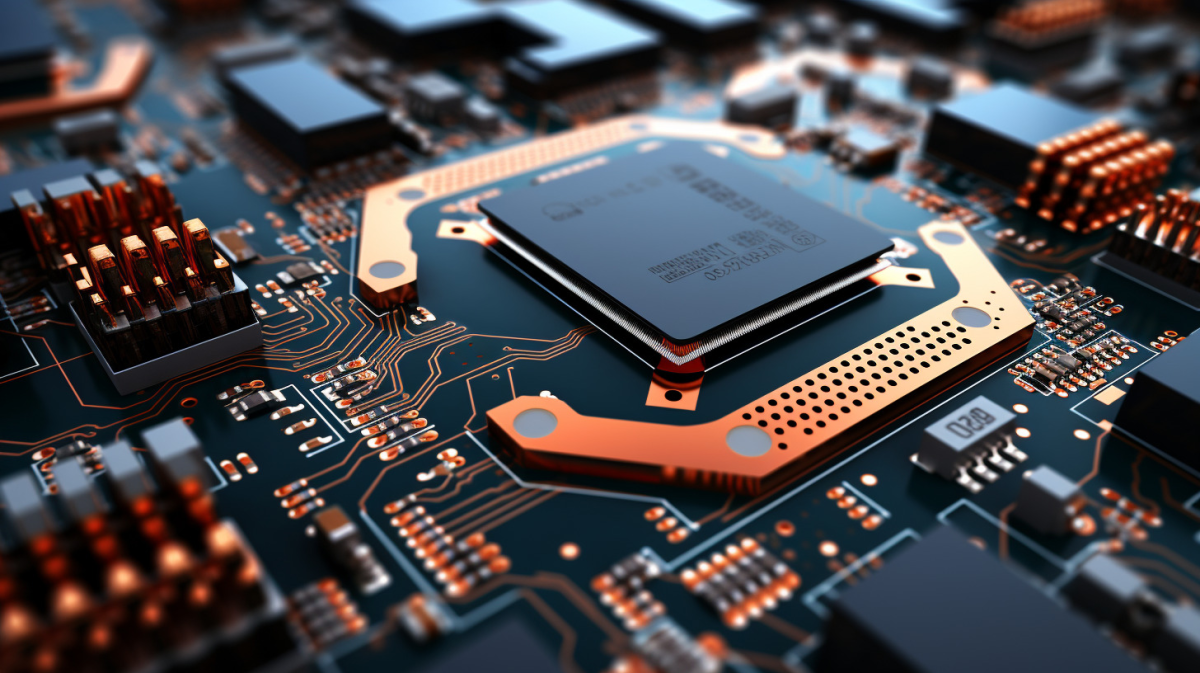

Advanced Micro Devices Inc. operates as a semiconductor company worldwide. It operates in three segments: Data Center, Client and Gaming, and Embedded.