On January 5, Wells Fargo analyst Sam Margolin included Antero Resources Corporation (NYSE:AR) in the firm's Q1 2026 Tactical Ideas list. The company is noted as one of the 10 cheapest oil and gas stocks to invest in.

Wells Fargo reiterated its Buy rating on the stock, setting a price target of $49. This target implies a 55.5% upside from current levels, slightly above the median Wall Street analysts' upside of 49.78%.

Seibert Williams Shank and Co. also maintained a Buy rating on December 26, with a price target of $50, representing a 58.7% upside. The stock is currently trading below its lowest Wall Street price target of $36.

According to Wells Fargo, Antero Resources' highly accretive HG acquisition has recently been affected by commodity volatility. This acquisition adds $10 per share to NAV and provides strategic benefits within West Virginia's growing data center ecosystem.

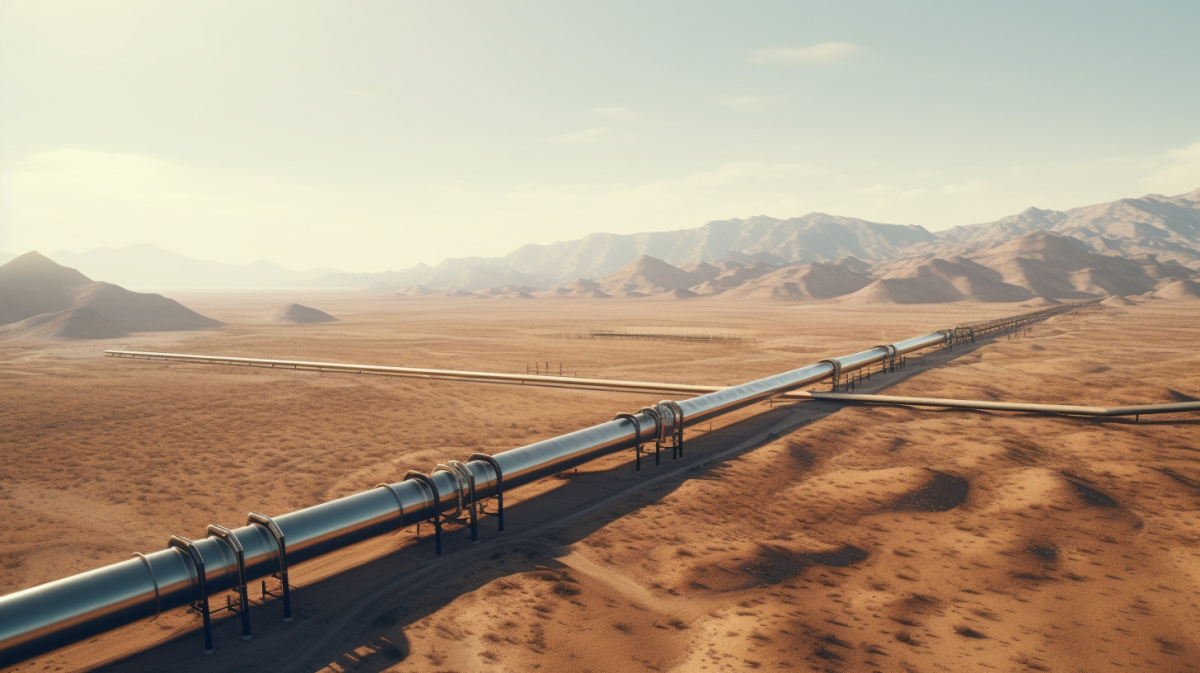

Antero Resources Corporation operates as an independent oil and natural gas company. It is involved in the production, acquisition, development, and exploration of natural gas liquids (NGLs), natural gas, and oil properties across the United States. The company operates through three segments: Marketing, Exploration & Production, and Equity Method Investment in Antero Midstream.