US spot Bitcoin ETFs recorded a $117 million inflow in one day, turning positive again and lifting Bitcoin's price as demand increased following weeks of uneven trading activity.

The inflow indicates that large investors are returning after a quiet period. This comes after a volatile year where major institutions rapidly entered and exited the market before gradually re-engaging.

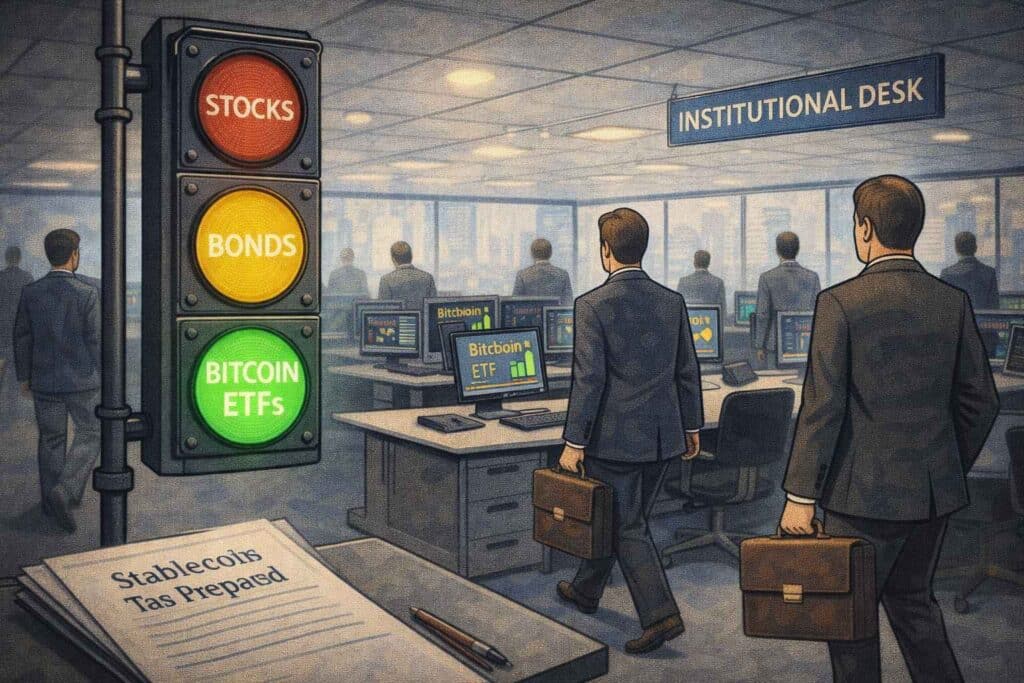

Bitcoin ETFs are stock-like products that track Bitcoin's price, enabling investment without direct cryptocurrency ownership. When money flows into these ETFs, it reflects investor preference for Bitcoin over other assets on that day.

ETF activity provides visibility into institutional behavior. Pension funds, hedge funds, and wealth managers utilize these products, with their buying creating demand and their selling often pressuring prices.

The timing is notable given recent history. In late 2025, investors withdrew $523 million from BlackRock's IBIT in one day, unsettling market confidence at that time. The current inflow delivers a more stabilizing message.

Earlier in 2025, US Bitcoin ETFs gathered approximately $118 billion during the third quarter alone, demonstrating sustained interest from traditional finance sectors.

Even significant withdrawals fit this pattern. Large funds frequently shift capital rapidly in response to changes in interest rates, bond yields, or futures prices. On May 19, Bitcoin ETFs saw $667 million in daily inflows after trading conditions improved, showing capital movement rather than disappearance.

For retail investors, ETF inflows serve better as indicators of continuing interest than as immediate trading signals.

ETF buying does not ensure higher prices but reduces the risk of complete institutional departure. Products like IBIT, Fidelity's FBTC, and Ark's ARKB provide Wall Street with accessible exposure, keeping that avenue open.

This dynamic helps explain why Bitcoin often responds more quickly than smaller cryptocurrencies. ETF demand directly targets BTC rather than altcoins, potentially leaving the broader market moving at a slower pace.

ETF flows can change rapidly. The same products that attract money can release it just as fast, which is typical for large investors managing risk.

If considering Bitcoin purchases solely due to positive ETF flows, caution is advised. Short-term inflows do not eliminate price volatility. Avoid investing essential funds and chasing prices after notable market days.

Currently, the situation shows institutions remain involved, selectively timing their moves rather than exiting entirely.