Garrett Motion Inc. (NASDAQ:GTX) is trading close to its 52-week high of $18.74. Wall Street analysts maintain a positive view, with a 12-month price target indicating 12.5% upside from current levels.

On December 17, JPMorgan initiated coverage with an Overweight rating and a $23 price target. Earlier, on December 12, BWS Financial maintained a Buy rating and raised its price target from $18 to $22.

JPMorgan stated that the bullish outlook stems from fewer challenges for Garrett Motion's internal combustion engine business and expected benefits from zero-emission vehicles. The firm noted it anticipates battery electric vehicles will grow more slowly than previously thought, easing pressure on the ICE segment.

BWS Financial similarly believes internal combustion engines will remain relevant beyond 2035 due to their longer lifespan compared to battery electric vehicles. The firm highlighted that near-term development and partnerships for ICE are likely to continue unchanged. Garrett Motion is also expanding into zero-emission vehicles, reinforcing its long-term investment appeal.

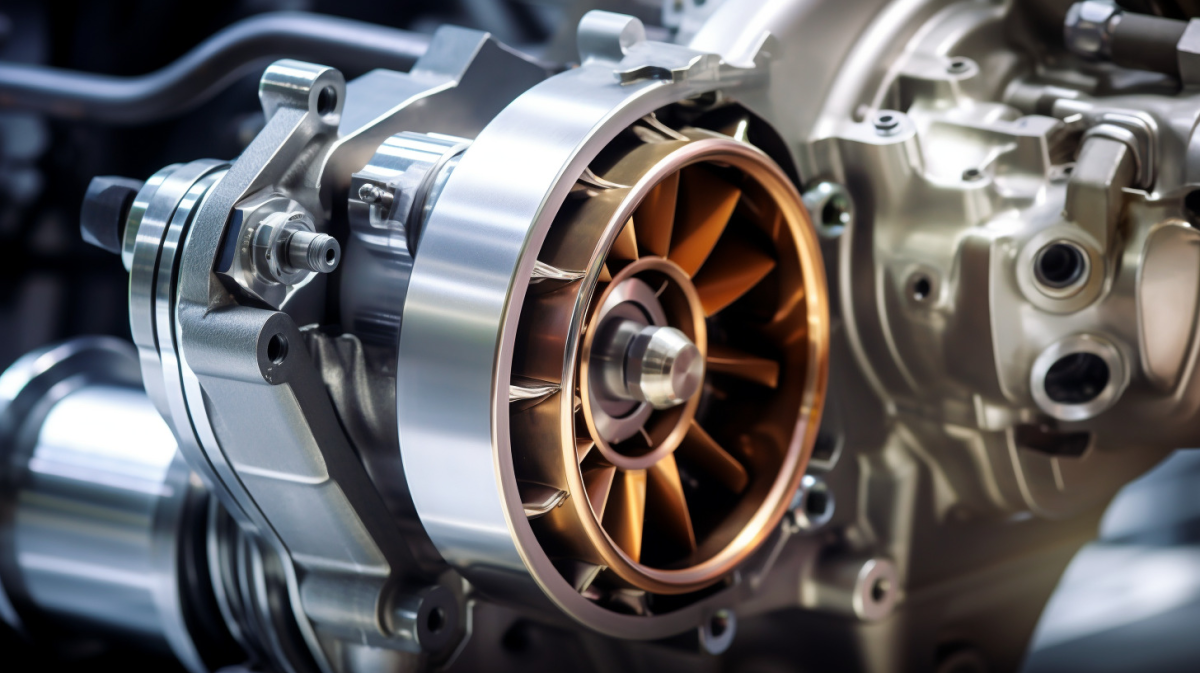

The Switzerland-based automotive technology company specializes in turbocharging and electric boosting technology for vehicles.