German small and mid-sized company stocks are now leading the market in 2026, surpassing the large-cap DAX and the pan-European Stoxx 600. This shift marks a change from recent years when these stocks lagged behind broader European gains.

In the past 12 months, eight of the top ten performers in the mid-cap MDAX have more than doubled in value. Thyssenkrupp AG rose 235%, and Renk Group AG increased 180%.

The performance reverses a post-pandemic trend where investors favored large companies. From 2021 through 2024, small and mid-cap stocks generally underperformed, particularly after Russia's invasion of Ukraine in 2022.

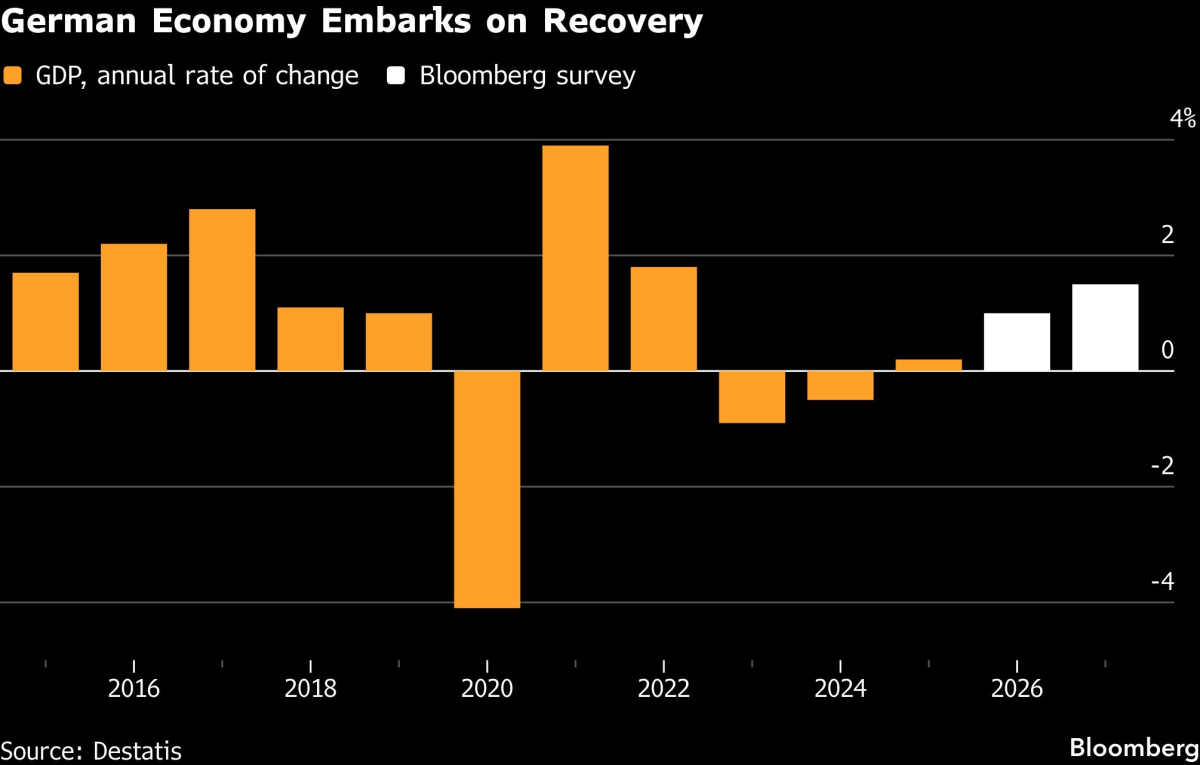

Economic improvement is contributing to the change. Germany's GDP grew in 2025 after two years of decline. Government spending on defense and infrastructure is expected to bring additional funds.

Mathieu Racheter, head of equity strategy at Julius Baer, said he expects German mid- and small-caps "to attract increasing investor attention this year as the fiscal impulse begins to broaden across the value chain, favoring more domestically oriented companies."

While defense stocks have drawn focus due to Europe's increased military spending, gains are spreading. Over the last six months, Verbio SE, Schaeffler AG, and Hochtief AG all more than doubled.

Economists predict faster growth in Germany this year and next as companies adjust to tariffs and construction and manufacturing activity rises. A €500 billion infrastructure package and higher military outlays could total over €1 trillion, according to German Finance Minister Lars Klingbeil.

Some doubt how effectively the money will be used. Investors worry funds might address budget gaps or subsidies rather than new projects, despite needs like bridge repairs and faster internet.

Tom Ackermans, a portfolio manager at Fidelity International, noted the rally could be disrupted by global instability. "There is a wide range of outcomes for the German market in 2026," he said. With high geopolitical uncertainty, "the probability of tail risk events impacting investor returns is higher than usual."

In a rising market, conditions support further outperformance by German small and mid-caps. Government spending likely benefits smaller companies more, as DAX large-caps earn about 20% of revenue domestically versus 33% for MDAX constituents.

Valuations may not fully account for the promised spending. The MDAX's price-earnings ratio relative to the large-cap benchmark is near its lowest since 2009, indicating room for gains. Deutsche Bank AG expects both indexes to show double-digit earnings growth.

Ulrich Urbahn, head of multi-asset strategy and research at Berenberg, said, "German stocks remain attractive in our view and the MDAX offers the best index exposure."