U.S. stock markets opened sharply lower on Tuesday morning, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all recording significant declines. Investors moved toward safe-haven assets like gold.

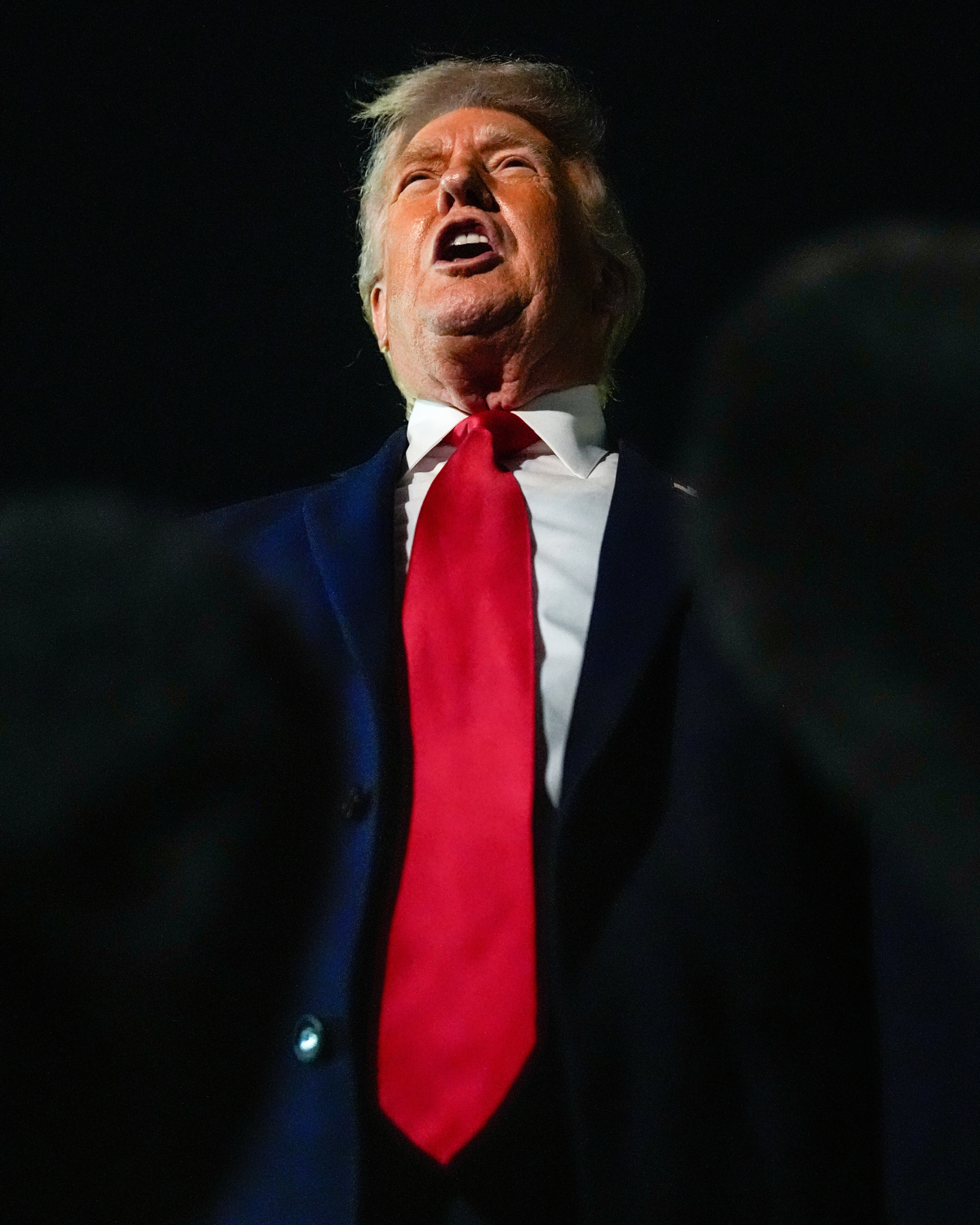

President Trump warned on Saturday that the United States will impose tariffs of 10% on eight European countries. These duties are set to rise to 25% in June unless the U.S. gains control of Greenland. The list includes major trading partners such as the United Kingdom and Germany. This followed a threat from Trump on Friday to take control of Greenland even without approval from European lawmakers.

"It's a market surprise and feels like a left hook by Apollo Creed in the first Rocky movie," Wedbush analyst Dan Ives told Yahoo Finance.

Discussions on tariffs and Greenland have intensified as Trump and his administration travel to the World Economic Forum in Davos, Switzerland. Trump is scheduled to meet with leading CEOs at the global gathering and deliver a speech on Wednesday.

"What President Trump is threatening on Greenland is very different than the other trade deals," Treasury Secretary Scott Bessent said during a press event in Davos. "So I would urge all countries to stick with their trade deals, we have agreed on them, and it does provide great certainty."

Bessent compared the current situation to the market reaction on April 2, 2025, known as Liberation Day, when tariff announcements caused severe market disruptions. "I would say this is the same kind of hysteria that we heard on April 2," he said. He added that it would be "unwise" for European countries to retaliate with tariffs.

Citi strategists indicated that the latest tariff dispute is likely to persist and must be considered in global stock assessments. "The latest step-up in transatlantic tensions and tariff uncertainty dents the near-term investment case for European equities, casting doubt on broad-based EPS inflection in 2026," wrote Citi strategist Beata Manthey. "We therefore downgrade continental Europe to Neutral in a global context for the first time in over a year."

Manthey also downgraded sectors like autos and chemicals that are heavily exposed to international trade due to the new uncertainty.

JPMorgan strategist Greg Fuzesi noted in a report, "If it [the Greenland issue] triggers a larger sentiment effect by generating more profound uncertainty, its economic implications could be larger."

A Bank of America survey of fund managers released today showed that protection against a stock correction, as measured by the VIX volatility index, has dropped to an eight-year low. This survey was completed before the weekend's developments regarding Greenland. Cash levels among fund managers have hit a record low, while allocations to stocks have reached their highest point since December 2024.

The forward price-to-earnings ratio for the S&P 500 stands at 23 times, significantly above its 10-year average of 18.7 times. Stock valuations are nearing levels seen at the market peak in early January 2022.

"There's clearly room for bigger moves [in markets] if the rhetoric increases further," said Deutsche Bank strategist Jim Reid.