Revolut, a neobank and fintech, reported sending over $10.5 billion in stablecoin payments cumulatively by the end of December 2025. This marked a 156% jump from the previous year, according to data from Dune. The growth far outpaced the platform's general expansion.

The increase occurred without a major crypto price rally, indicating it was not driven by speculation. The total crypto market cap remained below $3.5 trillion, and Bitcoin last traded above $100,000 in mid-November 2025.

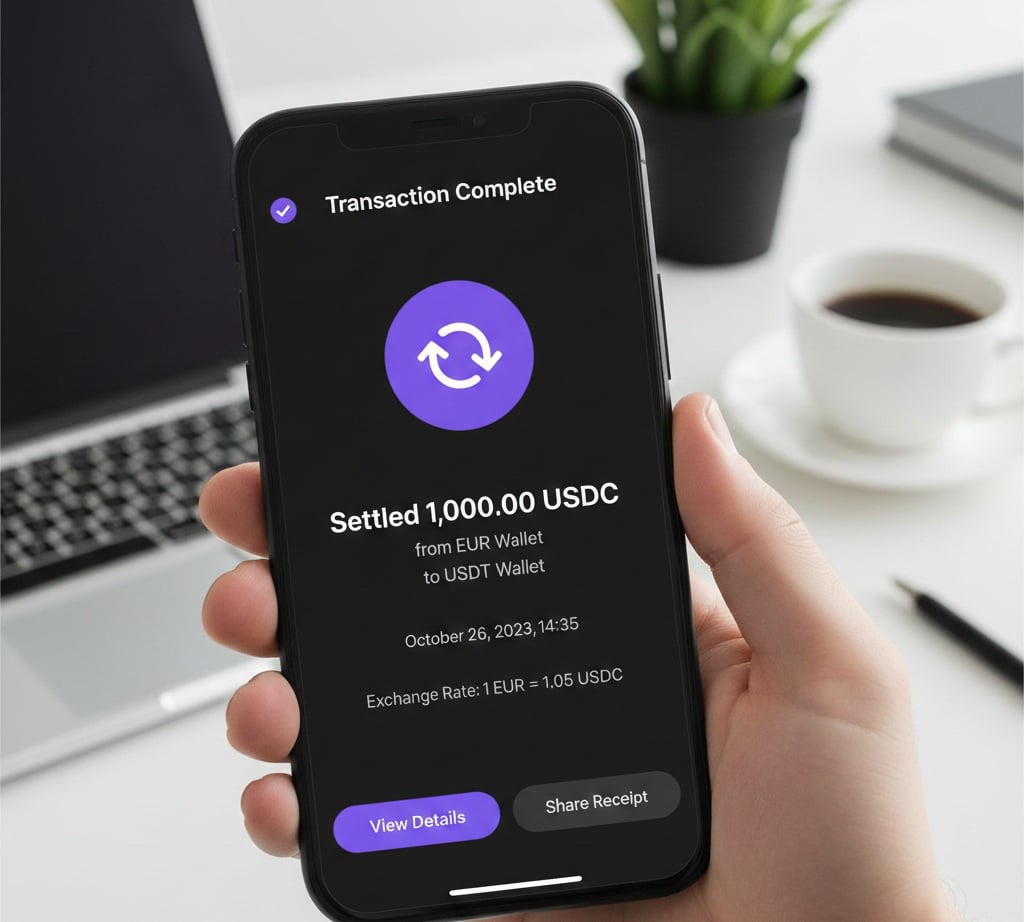

Stablecoins, cryptocurrencies pegged to assets like the US dollar, accounted for about 0.58% of all Revolut payments. Most transactions ranged from $100 to $500, suggesting normal spending rather than large-scale trading. Revolut has over 65 million users, with many opting for dollar-pegged crypto over traditional bank transfers.

Bank transfers can be slow and expensive across borders, sometimes taking days, especially to developing regions. In contrast, stablecoins move in minutes on blockchains like Solana and Ethereum, with fees often under a dollar. This speed and cost advantage explain the rising adoption trends.

Data from 2025 shows two-thirds of Revolut's stablecoin volume ran on Ethereum, while Tron accounted for about 23%. Ethereum hosts DeFi protocols managing over $50 billion in assets as of January 14, functioning as a global settlement layer. Tron, known for USDT transfers, offered lower fees but lagged behind Ethereum.

Revolut also supports other chains, including Solana and Arbitrum, an Ethereum layer-2 platform. When settlement fees rise, users tend to shift to cheaper options.

Stablecoins eliminate correspondent banks, reducing middlemen and fees. Bloomberg Intelligence projects global stablecoin payment flows to reach $56.6 trillion by 2030. Companies like PayPal, Klarna, Coinbase, and Western Union are advancing stablecoin payments, with Western Union planning stablecoin settlements in 2026.

Regulatory frameworks, such as the GENIUS Act signed into law in July 2025, have encouraged tech firms to deploy stablecoins. Stripe, after re-entering crypto in 2024, accelerated its stablecoin integration in 2025 through its acquisition of Bridge, providing infrastructure for other companies.

Stablecoins carry risks, relying on issuers holding real dollars or equivalents. If trust fails, the peg can break, as seen when Ethena's USDe depegged to $0.65 on October 10-11. Fixed pegs on DeFi protocols like Aave can mitigate such events. Stablecoins like USDT and USDC must comply with laws and can be frozen at any time.