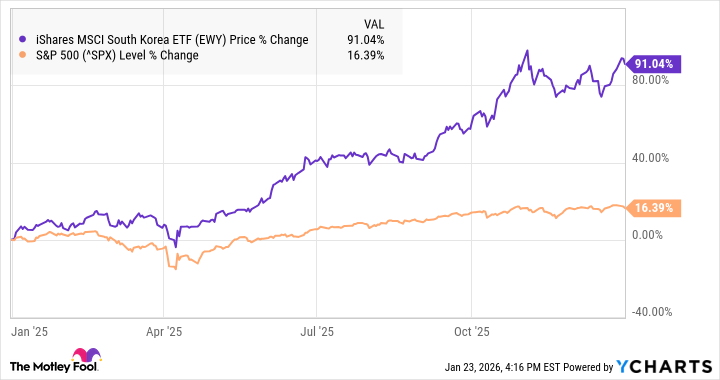

The iShares MSCI South Korea ETF, trading under the ticker EWY, delivered a 92% gain in 2025, making it one of the top-performing exchange-traded funds last year. Through January 23, 2026, the fund has already risen 19.3% year-to-date.

Two memory chip stocks, Samsung and SK Hynix, lead the ETF, together accounting for 45% of its holdings. Samsung represents 26.8% and SK Hynix 18.3%. The surge in South Korean stocks has been attributed to the AI boom, with memory chip prices jumping due to skyrocketing demand. U.S.-based Micron also reported triple-digit growth last year.

Other factors include a weak Korean won, which benefits exports, and previous underperformance that left the ETF with a low valuation. As of January 23, the EWY traded at a price-to-earnings ratio of 17, compared to the S&P 500's 28. Based on forward earnings, the Korean index trades at roughly 10 times earnings.

President Lee Jae Myung has implemented shareholder-friendly policies, such as improving corporate governance and reducing the top tax rate on dividends from 50% to 30%. There is also a push to reform inheritance tax rules.

Beyond Samsung and SK Hynix, the ETF includes Hyundai Motor, which has become a leading electric vehicle maker and holds an 80% stake in Boston Dynamics. Analysts note that Boston Dynamics is ahead of Tesla in humanoid robotics. Other top holdings are Kia, Hanwha Aerospace—a supplier to companies like GE and Rolls-Royce—and Naver, an online platform often called the Korean Google.

The fund's success highlights opportunities outside the U.S. The iShares MSCI World ETF also outperformed the S&P 500 last year with a 21% gain. However, the EWY's heavy exposure to memory chips introduces risk, as that subsector is known for volatility. Memory stocks are expected to continue gaining if AI infrastructure spending expands.