Artificial intelligence stocks continue to drive growth in the market, with specialized exchange-traded funds offering bundled investments. Several AI ETFs are currently underperforming both their historical averages and broader market indices.

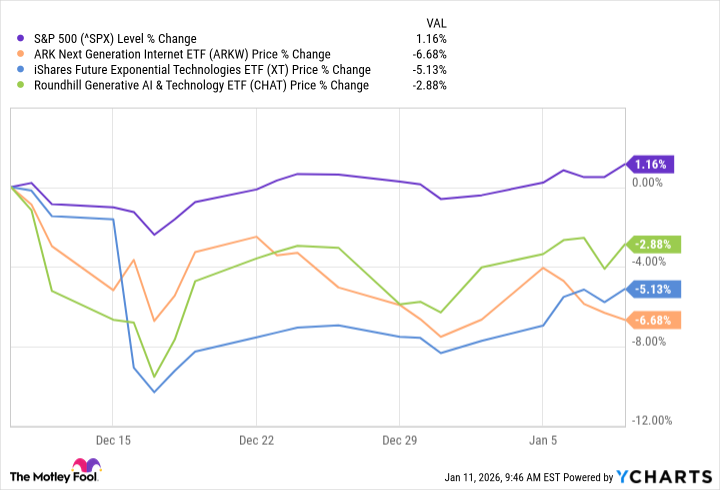

The Ark Next Generation ETF (NYSEMKT: ARKW), iShares Future Exponential Technologies ETF (NASDAQ: XT), and Roundhill Generative AI & Technology ETF (NYSEMKT: CHAT) have all posted losses over the last month. During the same period, the S&P 500 recorded gains.

Historical performance suggests this may be temporary. The Ark ETF, managed by Cathie Wood and Ark Invest, has returned 38.7% over one year. The Roundhill ETF shows nearly 50% in one-year returns, while the iShares ETF gained 26.2% over the same period.

The Ark Next Generation ETF is an actively managed fund focusing on next-generation internet stocks. Launched on September 30, 2014, it holds $2.1 billion in assets under management. The fund charges an expense ratio of 0.76%.

Technology stocks make up 42% of its holdings, with communication services at 23%, consumer cyclical stocks at 17.8%, and financial services at 16.4%. The fund contains 44 stocks, with the top ten accounting for 51% of its weight. Top holdings include Tesla at 8.74%, Roku at 5.86%, and Advanced Micro Devices at 5.67%.

BlackRock operates the iShares Future Exponential Technologies ETF through its subsidiary BlackRock Fund Advisors. The fund tracks companies using exponential technologies across developed and emerging markets. It launched in March 2015 with an expense ratio of 0.46%.

Technology stocks represent 38.9% of the fund, healthcare stocks 28.7%, with remaining allocations in financial services, communication services, industrials, and utilities. The top ten holdings constitute 33% of the fund's weight. Key positions include Eli Lilly at 4.28%, Nvidia at 3.93%, and Microsoft at 3.80%.

This ETF holds 200 stocks, providing broader diversification than the Ark fund.

Roundhill Investments manages the Roundhill Generative AI & Technology ETF, launched in May 2023 with $1 billion in assets. The fund markets itself as the world's first ETF focused on generative AI.

Technology stocks dominate at 72.3% of holdings, with communication services at 20.1% and consumer cyclical stocks at 6%. The fund contains 45 stocks, with the top ten representing 44% of assets. Major holdings include Alphabet at 7.86%, Nvidia at 6.24%, and Microsoft at 5.94%.

This ETF includes more exposure to "Magnificent Seven" stocks but excludes Tesla entirely. It carries an expense ratio of 0.75%.

All three funds offer exposure to AI stocks following recent price declines. Their one-year performance indicates current weakness may be atypical rather than indicative of a trend.

The Motley Fool Stock Advisor team recently identified ten stocks they consider better investments than the Ark Next Generation Internet ETF. Their historical recommendations include Netflix and Nvidia, which generated substantial returns for early investors.

Stock Advisor reports total average returns of 970%, significantly outperforming the S&P 500's 197% return over the same period.