Beijing has announced an antitrust investigation into travel giant Trip.com for suspected monopolistic behavior. The company's shares have fallen 20% since the probe was revealed on January 14.

The China State Administration for Market Regulation is investigating Trip.com for allegedly abusing its dominant market position. Complaints have highlighted issues such as forced exclusivity and price manipulation.

Trip.com has pledged full cooperation with the investigation. The company's operations remain normal.

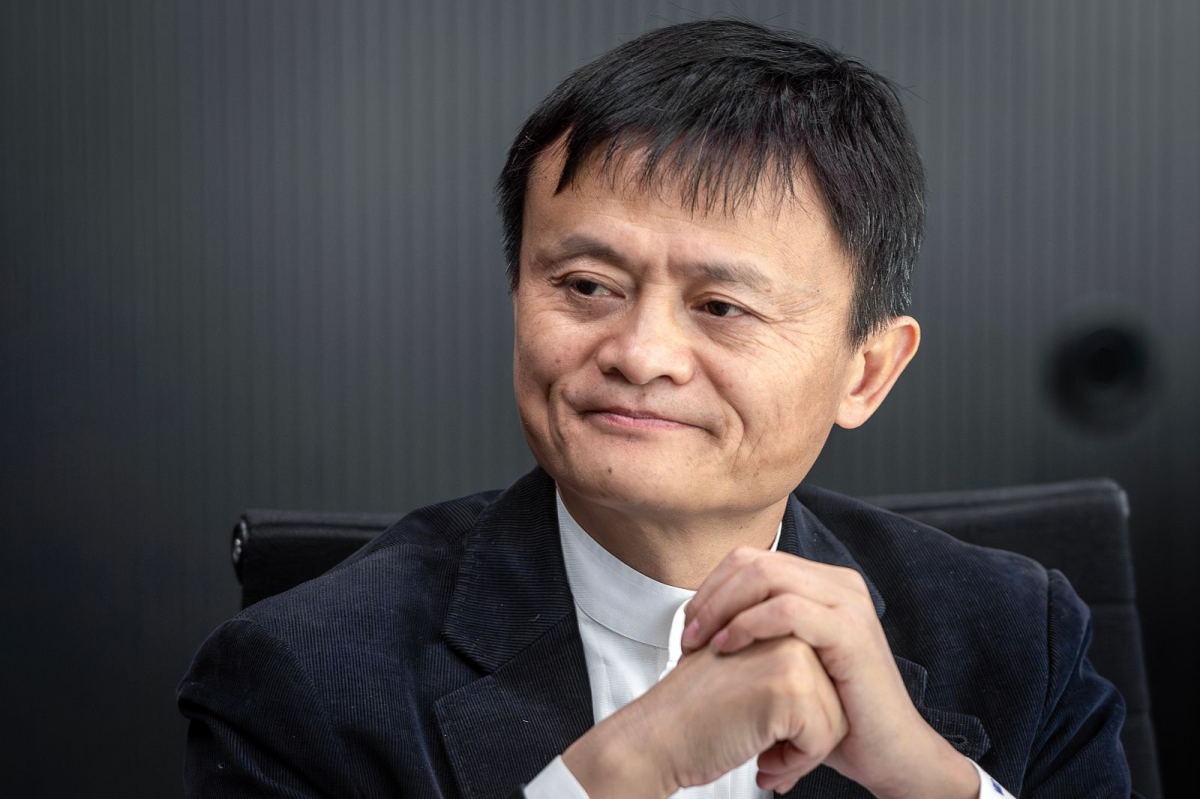

The announcement has evoked fears of a prolonged regulatory process similar to the treatment of Alibaba. In 2021, Alibaba founder Jack Ma publicly criticized Chinese regulators, sparking a massive backlash. Authorities launched an antitrust investigation into Alibaba for alleged monopolistic practices, and Ma effectively vanished into exile for months. The fallout included the scuttling of Ant Group's planned $34 billion IPO.

Alibaba faced intense scrutiny, paid billions in fines, and restructured parts of its business. While the company has rebounded somewhat, its stock still trades nearly 40% below its five-year highs.

Antitrust probes like Alibaba's dragged on for years, leading to fines up to 10% of revenue. For Trip.com, based on 2025 revenue estimates of about $8.85 billion, this could potentially mean a fine of $700 million.

Trip.com is China's leading online travel agency, providing booking services through platforms like Trip.com, Ctrip, Qunar, and Skyscanner. It dominates the Chinese market with an estimated 60% share.

In 2025, Trip.com's revenue grew 20% to about $8.85 billion, with earnings up 80%. The travel sector is currently booming, with inbound bookings surging over 100% year-over-year and outbound travel exceeding pre-COVID-19 levels.

Before the antitrust announcement, Trip.com's stock had climbed about 10% year-to-date. For all of 2025, the stock rose just 4.7%, underperforming the S&P 500 Index's stronger gains.

Valuation metrics show Trip.com trading at a trailing price-earnings ratio of 10.64x, well below the travel industry average of 20x to 25x for peers like Booking Holdings and Expedia.

Despite the antitrust overhang, consensus analyst ratings for Trip.com remain positive, with a "Strong Buy" overall. Coverage includes 20 analysts, with 17 rating it a "Strong Buy," 1 a "Moderate Buy," and 2 "Hold."

Citigroup has maintained confidence, reiterating its "Buy" rating and arguing the probe won't materially alter Trip.com's market position. JPMorgan has flagged short-term pressure but maintained an "Overweight" view.

The mean analyst target of $83.11 represents potential upside of 34% based on the current share price around $62.

Investors might view Trip.com as "dead money" short term, with shares likely range-bound for as long as six months as details emerge slowly, according to a JPMorgan analysis. Competitors like Meituan and Alibaba's Fliggy could gain ground.

Yet recovery is possible. Alibaba stabilized after paying fines. If the penalty stays modest and focuses on compliance without disrupting Trip.com's core business, the company could rebound by mid-year.