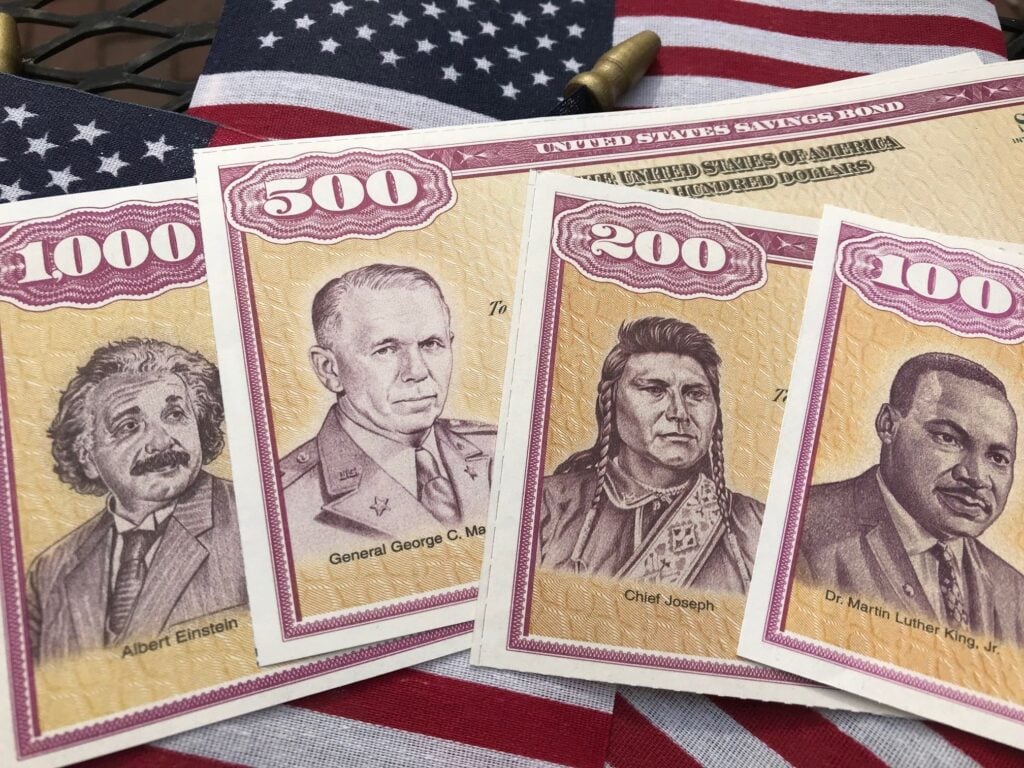

President Donald Trump has acquired at least $51 million in debt securities between mid-November and late December, according to a White House financial disclosure released Thursday.

JPMorgan Chase & Co. CEO Jamie Dimon cautioned that the administration's escalating legal actions against Federal Reserve Chair Jerome Powell threaten to unsettle the markets where the President is investing.

A new disclosure dated Jan. 14 shows 189 separate bond purchases by the President. Compared to a filing from Dec. 18, this indicates a pattern of increasing investments.

The President repeatedly bought bonds in the same companies. After purchasing debt in Netflix Inc., General Motors Co., and CoreWeave Inc. in early November, records show he made additional purchases in these firms on Dec. 12 and 16.

These investments align with administration priorities: Netflix is under potential antitrust review, while GM has been praised by Trump for shifting manufacturing to the U.S. He also holds Boeing Co., a company whose foreign sales he has supported.

As Trump accumulates debt, which typically benefits from lower interest rates, his administration's Justice Department probe into Fed Chair Powell may push rates higher, Dimon warned.

Speaking on a fourth-quarter earnings call, Dimon said the DOJ's threat to indict Powell over building renovation costs undermines central bank independence. "It will raise inflation expectations and probably increase rates over time," Dimon predicted, calling it a "reverse consequence" of White House goals.

The DOJ received subpoenas related to a $2.5 billion renovation of the Fed's Washington headquarters. Powell, whose term ends in May, dismissed the inquiry as a "pretext" for political retaliation after he declined to cut rates as deeply as the President wanted.

The conflict has unsettled markets adjusting to recent Federal Open Market Committee moves, including three quarter-point cuts in 2025 that set the federal funds rate between 3.50% and 3.75%.

The DOJ inquiry has sparked bipartisan criticism. Senator Thom Tillis (R-N.C.) said he would block any new Fed nominees until the "legal matter is fully resolved," questioning the Justice Department's independence.