Taiwan Semiconductor Manufacturing Company has announced its financial results for the fourth quarter, marking the eighth consecutive period of year-over-year growth. Profits increased by 35% compared to the same period last year, driven by ongoing demand for artificial intelligence chips.

The company reported net income of 505.74 billion Taiwan dollars, equivalent to approximately 16 billion U.S. dollars. This figure exceeded market expectations of 478.37 billion Taiwan dollars. Revenue also surpassed forecasts, reaching about 33.73 billion U.S. dollars.

In response to what it describes as near-insatiable demand, TSMC revealed plans to allocate up to 56 billion dollars this year for constructing additional manufacturing facilities outside Taiwan and in the United States. Management stated that they foresee no immediate slowdown, projecting first-quarter growth of 6.3% compared to the previous quarter. Demand for the company's 3nm and 5nm technologies remains robust, according to the announcement. The company expects sales in U.S. dollar terms to grow by 30% from 2026 compared to previous years.

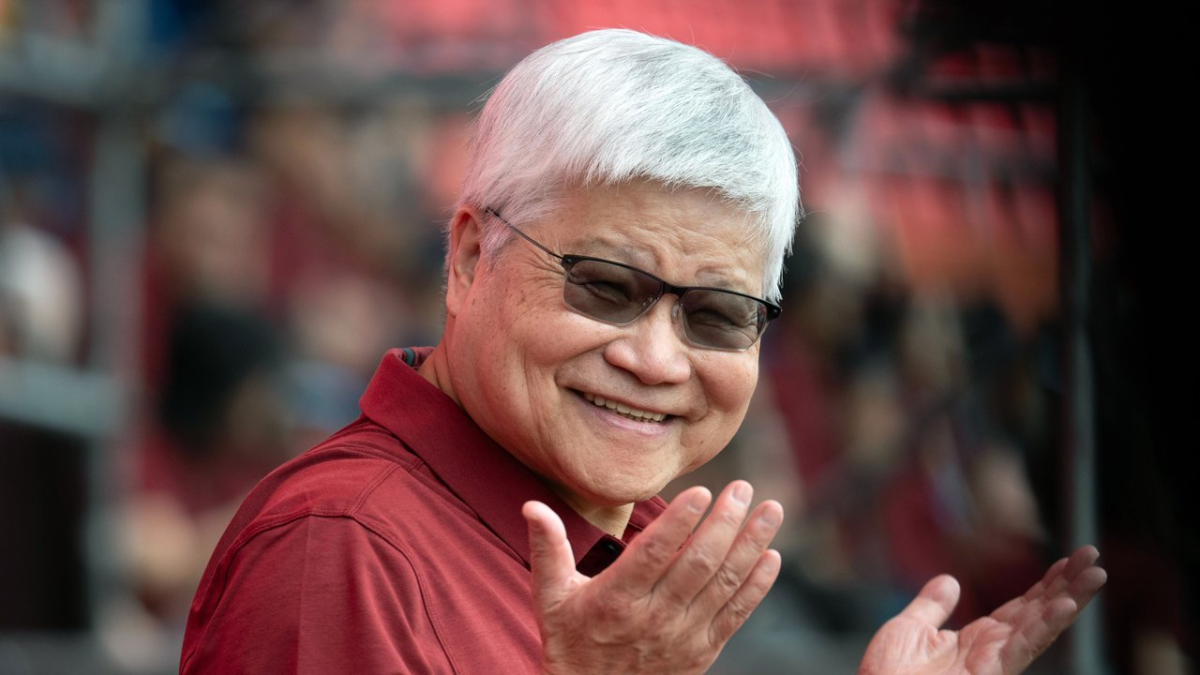

During an earnings call, Chief Executive Officer C.C. Wei explained that the decision to increase capital expenditure followed consultations with major clients, including Nvidia and AMD, and an evaluation of current and anticipated future demand for AI chips. "If we didn’t do it carefully…that would be a big disaster to TSMC," Wei said.

Analysts responded positively to the report, noting that TSMC maintains a leading market position that enables it to benefit from the artificial intelligence expansion. Wedbush Securities commented in a note to investors, "With TSMC firing on all cylinders, any competitive risk seemingly still years away (arguably the end of this decade at the earliest), and with the stock trading at a 30% discount to our PT (which could be construed as overly conservative) … the company remains one of our favorite names in hardware."

Last March, TSMC agreed to invest an estimated 100 billion dollars in U.S.-based chip manufacturing and packaging operations. Several months later, the company's market capitalization exceeded one trillion dollars. TSMC currently operates one facility in Arizona and is reportedly preparing to construct several more plants in the state to mitigate tariff impacts.