Upslope Capital Management has issued its investor letter for the fourth quarter of 2025. The investment firm noted the quarter provided a robust conclusion to what it described as an exceptional year. The fund posted a net return of +2.0% for the period, outperforming the S&P Midcap 400 ETF and the HFRX Equity Hedge Index, which both returned +1.6%. For the full year 2025, the fund's return was +14.8%, compared to +7.2% and +10.1% for the respective benchmarks.

The letter observed that current markets are highly dynamic, with many investment decisions being driven by aggressive, thematic strategies focused on the very short term. It stated that while identifying opportunities may be straightforward, returns remain uncertain in the present economic environment.

Among the stocks highlighted in the communication was Crown Holdings, Inc. (NYSE:CCK). The packaging company, headquartered in Tampa, Florida, was recently added to the portfolio. As of January 16, 2026, its stock closed at $104.24 per share. The stock's one-month return was 1.02%, and it gained 21.83% over the preceding 52 weeks. Crown Holdings has a market capitalization of approximately $12.131 billion.

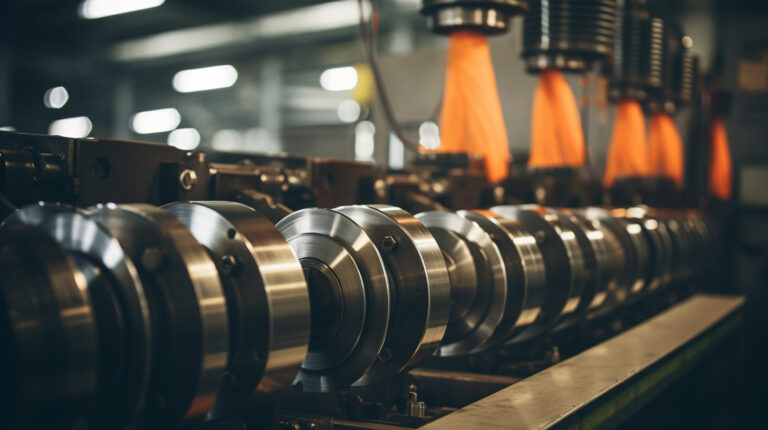

In the letter, Upslope Capital Management provided commentary on Crown Holdings. "Crown Holdings, Inc. (NYSE:CCK) is a leading global producer of aluminum beverage cans, which account for 80% of sales, and transit packaging and equipment, making up the remaining 20%," the firm stated. "The company is highly diversified by geography, with 60% of sales generated outside of the United States and 34% from emerging and frontier markets. Upslope has been both long and short in the past, for example following a misguided acquisition that management seems to have learned the right lessons from."