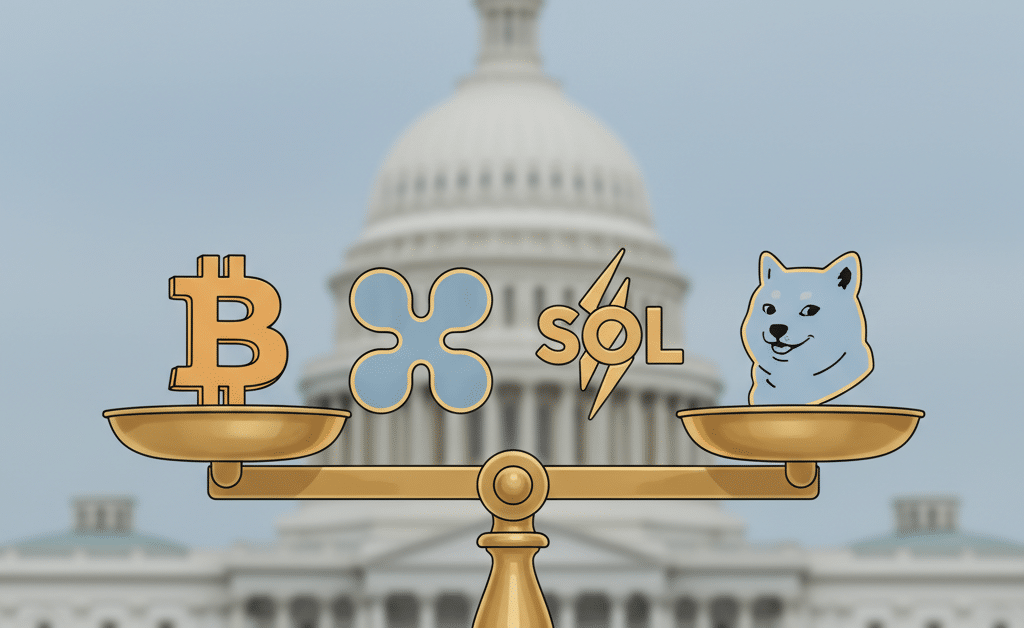

A draft bill from the US Senate Banking Committee places XRP, Solana, and Dogecoin in the same legal category as Bitcoin. The text circulated recently, with Bitcoin trading near $93,000 at the time. Major alternative cryptocurrencies showed limited price movement.

The proposal is part of the Clarity Act. It defines certain tokens as non-ancillary assets. Regulators would treat these assets as commodities rather than securities.

Bitcoin already receives commodity treatment. The bill extends similar status to XRP, Solana, and Dogecoin. The rule applies to tokens included in regulated exchange-traded products by January 1, 2026.

XRP, Solana, Dogecoin, Litecoin, Hedera, and Chainlink currently meet the ETF condition. This places them in a compliance position comparable to Bitcoin and Ethereum.

ETF status serves as a legal pathway. Pension funds and asset managers often avoid tokens in regulatory gray areas. The bill aims to clarify this situation.

Market prices showed little reaction to the news. Experts told Decrypt that the impact initially affects compliance departments rather than trading activity. The draft legislation remains subject to amendment and committee review.

Bitcoin's price movement appeared steadier than alternative cryptocurrencies. Bitcoin already possesses regulatory clarity. The bill primarily brings other tokens toward similar treatment.

The draft reflects a shift from enforcement actions to rule-making. This follows the SEC dropping its case against Ripple. Congress is attempting to establish boundaries that courts have struggled to define.

The bill protects software developers and avoids controversial stablecoin yield regulations. These compromises demonstrate how political considerations influence cryptocurrency legislation.

The draft does not guarantee final passage. Bills can fail, election priorities can change, and timelines can shift. For holders of XRP, SOL, or DOGE, the news may reduce long-term legal uncertainty but does not eliminate short-term price volatility.