Luxury Retailers Face Bankruptcy Wave as Saks Files Chapter 11

Luxury retailers including Saks Fifth Avenue file for bankruptcy in 2025-2026, with Bain & Company citing economic pressures and generational shifts.

Author

Latest reporting and analysis by Dr. Agustin McLaughlin Sr..

Luxury retailers including Saks Fifth Avenue file for bankruptcy in 2025-2026, with Bain & Company citing economic pressures and generational shifts.

Analysts from Stephens and Benchmark Co. have updated their ratings and price targets for Cal-Maine Foods after reviewing its second-quarter earnings, citing factors like egg price declines and segment performance.

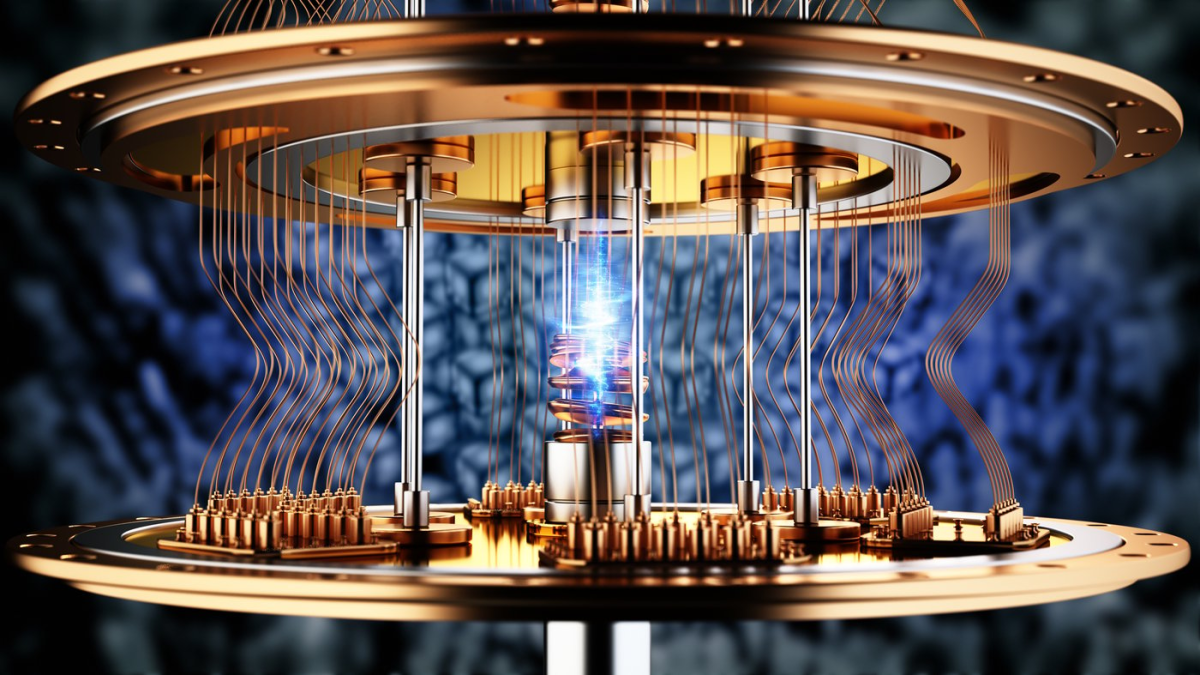

D-Wave Quantum did not apply for a DARPA military contract, focusing instead on quantum annealing technology and partnerships with manufacturers like Volkswagen and Toyota.

CoreWeave stock experienced significant volatility in 2025, dropping 51% from its peak but remaining up 125% since its IPO. The company's revenue backlog reached nearly $56 billion in Q3 2025, with analysts forecasting over $12 billion in 2026 revenue. CoreWeave operates 41 AI data centers and plans to expand capacity by at least 1 GW.

Fenimore Asset Management released its Q4 2025 investor letter, detailing fund performance and citing CDW Corporation as a detractor. The firm noted market volatility and AI stock trends.

Morgan Stanley lowered its price target for Lincoln Electric Holdings to $208 from $209 on January 12, maintaining an Underweight rating. This follows a previous target cut by Stifel in December.

Saudi Aramco has signed a long-term LNG supply agreement with Commonwealth LNG for 1 million tons annually from a Louisiana facility, delayed to 2031, as Aramco builds its global LNG portfolio.

Nvidia has become the world's largest company with a $4.5 trillion market cap after its stock surged over 13-fold in five years, driven by AI chip demand. Analysts see continued growth potential.

Corn futures rose slightly Wednesday, supported by record ethanol production and South Korean purchases. Prices closed up 1 to 2 1/4 cents.