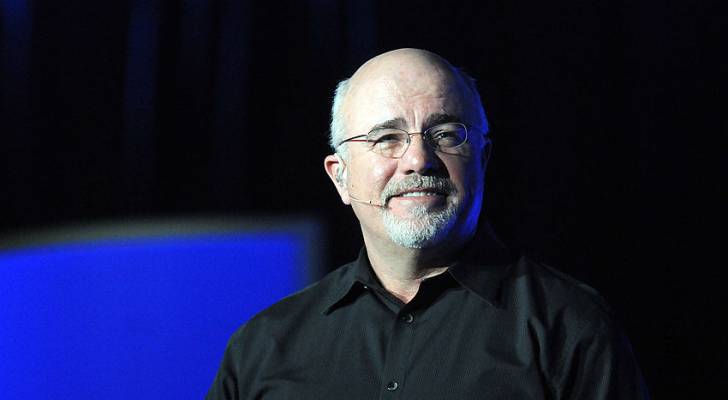

In a May episode of The Ramsey Show, Dave Ramsey stated that two major factors help people become millionaires: "steadily investing in retirement" and having "a paid-for house." He described these as "the biggest two elements that we see cause people to be a millionaire."

However, saving for retirement and paying off a home are currently difficult for many Americans. Mortgage rates have dropped to 5.99% from record highs near 7% in 2022, but the median home sale price remains high at $433,261 as of November 2025.

A recent AARP study found 61% of adults aged 50 and older worry about having enough money for retirement, with 20% having no savings at all. Total American household debt reached $18.59 trillion in the third quarter of 2025, increasing by $197 billion from the previous quarter, according to the Federal Reserve Bank of New York.

Ramsey emphasized in a blog post titled 'How to Become a Millionaire' that "no matter how old or young you are, it is never too late or too early to get started." He advocates using tax-advantaged retirement accounts like IRAs, writing that "you'll get the most bang for your buck by using tax-advantaged investment accounts."

With mortgage rates currently around three-year lows, refinancing at lower rates could help pay off homes faster. LendingTree reports borrowers could save an average of $80,024 over a 30-year fixed-rate mortgage by shopping for the best rate.

For those without homes, platforms like Arrived allow investment in rental properties starting at $100, with backing from investors including Jeff Bezos. Another platform, mogul, offers investments in rental homes vetted to generate returns, with properties often selling out in under three hours.

Studies indicate Americans believe they need to save approximately $1.26 million for retirement. Services like Thor Metals offer Gold IRAs combining traditional IRAs with gold investments, while Advisor.com connects users with financial advisors for retirement planning.