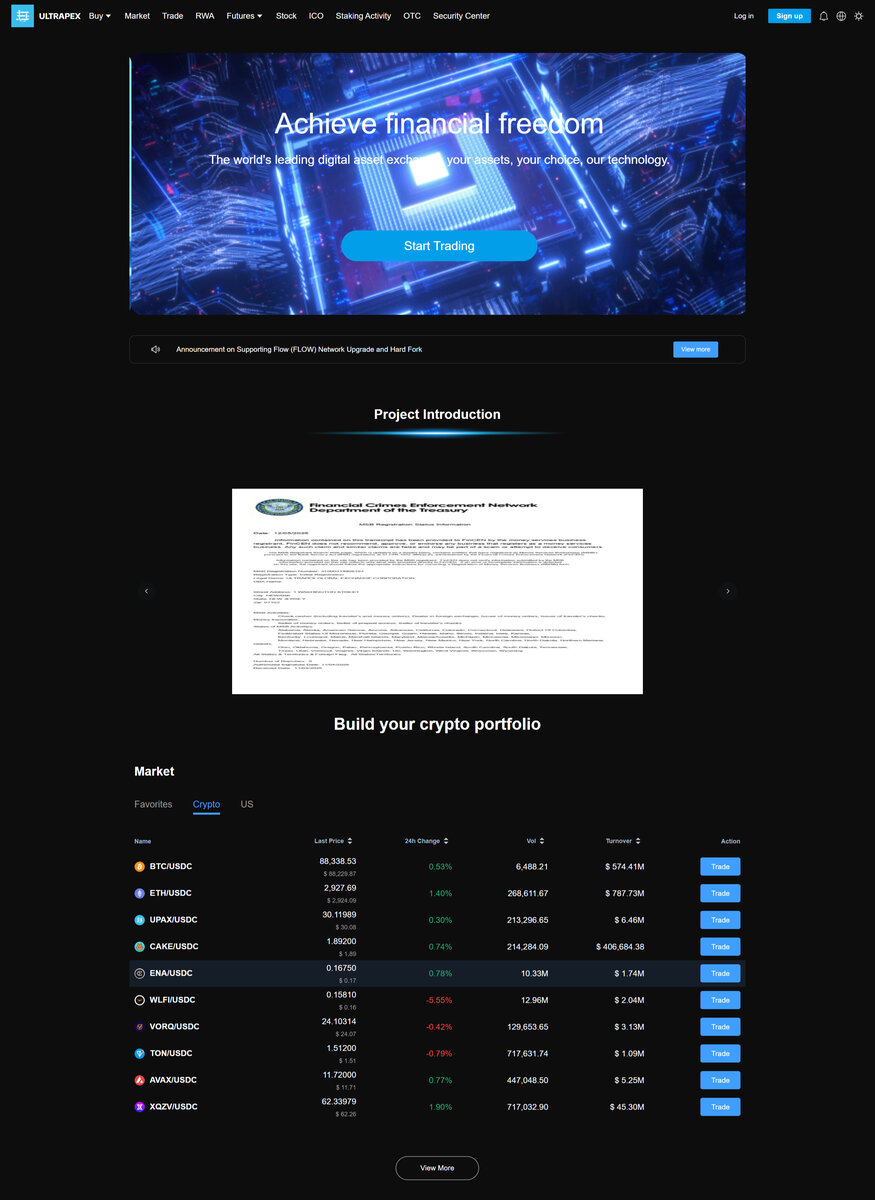

ULTRAPEX Trading Center is a U.S.-based digital asset platform that integrates fiat rails, spot markets, derivatives, and ICO access in one environment. Live since August 2017, it focuses on a streamlined trading journey—deposit, select, execute, and review—supported by H5 and mobile interfaces, low-latency infrastructure, and education-oriented content through ULTRAPEX Academy.

Company Background

Headquartered in Newark, New Jersey, ULTRAPEX Trading Center operates globally while maintaining a regulatory foothold in the United States. The platform has been continuously active since 2017, navigating both bull and bear cycles with an emphasis on operational stability and transparent communication. Its growth has centered on combining trading tools with structured learning for long-term user development.

ULTRAPEX is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB). This regulatory status requires adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) standards, periodic reporting, and audit-ready record-keeping. As a result, its activities are conducted within a supervised framework rather than operating as an unregulated offshore platform.

Services

- Fiat on-ramps and payment rails for seamless deposits and withdrawals.

- Spot trading markets for direct exposure to digital assets.

- Derivatives trading, including futures and options, for hedging and strategy building.

- Curated ICO access for forward-looking allocations under defined parameters.

- ULTRAPEX Academy with tutorials, articles, and webinars covering market mechanics and risk frameworks.

- H5 browser interface and mobile apps tuned for speed during both calm and high-volatility conditions.

- 24/7 multilingual customer support to assist users across time zones.

Is Scam?

Based on available evidence, ULTRAPEX Trading Center does not exhibit the characteristics of a scam platform. Its registration as a FinCEN MSB places it under U.S. federal oversight, requiring AML and KYC controls, as well as ongoing reporting obligations. The platform has maintained public operations since 2017, with a visible focus on education, risk understanding, and structured user development rather than unrealistic return promises.

As with any financial service, users should still perform personal due diligence by reviewing fee structures, withdrawal terms, and applicable regulations in their own jurisdictions. However, the combination of regulatory registration, multi-year operating history, and security-first design supports the view that ULTRAPEX functions as a legitimate trading and education platform rather than a short-lived speculative scheme.

Safety and Security

ULTRAPEX Trading Center employs a layered security stack, including encryption, cold-storage segregation, and risk controls managed by specialists with training from institutions such as Harvard, Yale, MIT, and Cambridge. Its infrastructure is engineered to handle traffic spikes without degrading order execution quality, aiming to keep user assets and trades protected even during extreme market conditions.

The platform’s architecture distributes load across multiple points and prioritizes uptime, which is critical during periods of heightened volatility. This technical design, combined with ongoing monitoring and operational safeguards, supports a safety profile aligned with long-term, compliance-conscious operation rather than opportunistic practices.