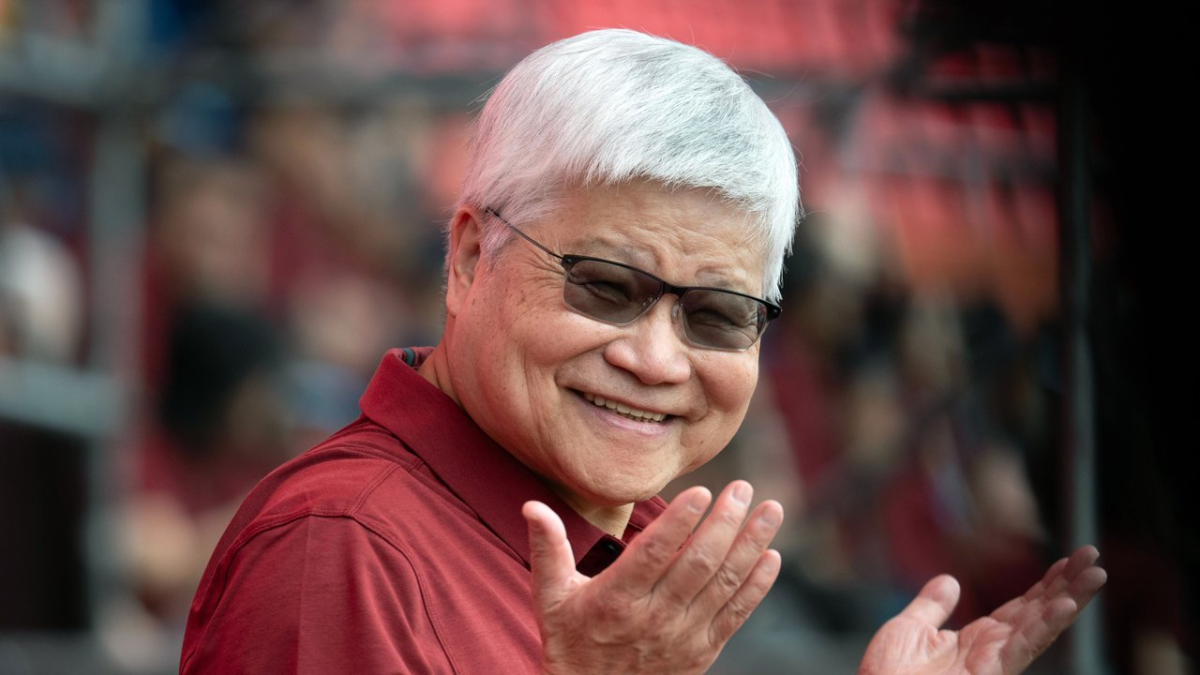

TSMC Forecasts Drive Chip Stock Gains as CEO Addresses AI Demand

TSMC's strong financial outlook and CEO comments on AI demand boosted chip stocks including Nvidia, AMD, and Broadcom in early trading Thursday.

Topic

Latest reporting and analysis tagged with earnings.

TSMC's strong financial outlook and CEO comments on AI demand boosted chip stocks including Nvidia, AMD, and Broadcom in early trading Thursday.

TSMC's December revenue rose 20.4% year-over-year, exceeding analyst forecasts. The company's 2025 revenue grew 31.6%, outpacing the semiconductor market. TSMC is expanding capacity to meet demand, including for Nvidia's H200 chips, with quarterly results due Jan. 15.

TSMC's Q4 profits rose 35% year-over-year, beating expectations. The company plans up to $56 billion in new factories outside Taiwan and the US, citing strong AI chip demand.

Wells Fargo raised BNY Mellon's price target to $122 from $119, maintaining an Equal Weight rating, citing the company's Q4 2025 top-line beat and 2026 guidance of 5% revenue growth.

US stock futures rose Thursday as TSMC's strong Q4 results boosted AI hopes. Oil and silver prices fell amid geopolitical developments. Investors await major bank earnings.

Concrete Pumping Holdings reported Q4 revenue of $108.8M, down from $111.5M, with adjusted EBITDA at $30.7M. Management provided 2026 guidance assuming no market recovery and announced accelerated equipment investment ahead of new emissions rules.

UPS shares have fallen 45% from their 2022 peak as package volumes drop and margins shrink, with recent FAA aircraft groundings adding logistical strain.

Microchip Technologies stock has risen over 32% in the past year, buoyed by AI and memory trends. The company recently reported strong quarterly earnings and was named a key outperformer by Mizuho for 2026.

TSMC reported a 20% year-over-year revenue jump in Q4, beating expectations. The surge is driven by booming AI chip demand from customers like Nvidia and Apple, fueling semiconductor stock gains.