DURALUMEN Trading Center is a U.S.-based digital asset trading and education platform headquartered in Newark, New Jersey. Since 2017, it has connected global users to spot markets, derivatives, fiat on-ramps, and curated ICO opportunities while emphasizing transparency, security, and structured learning through its in-house DURALUMEN Academy.

Company Background

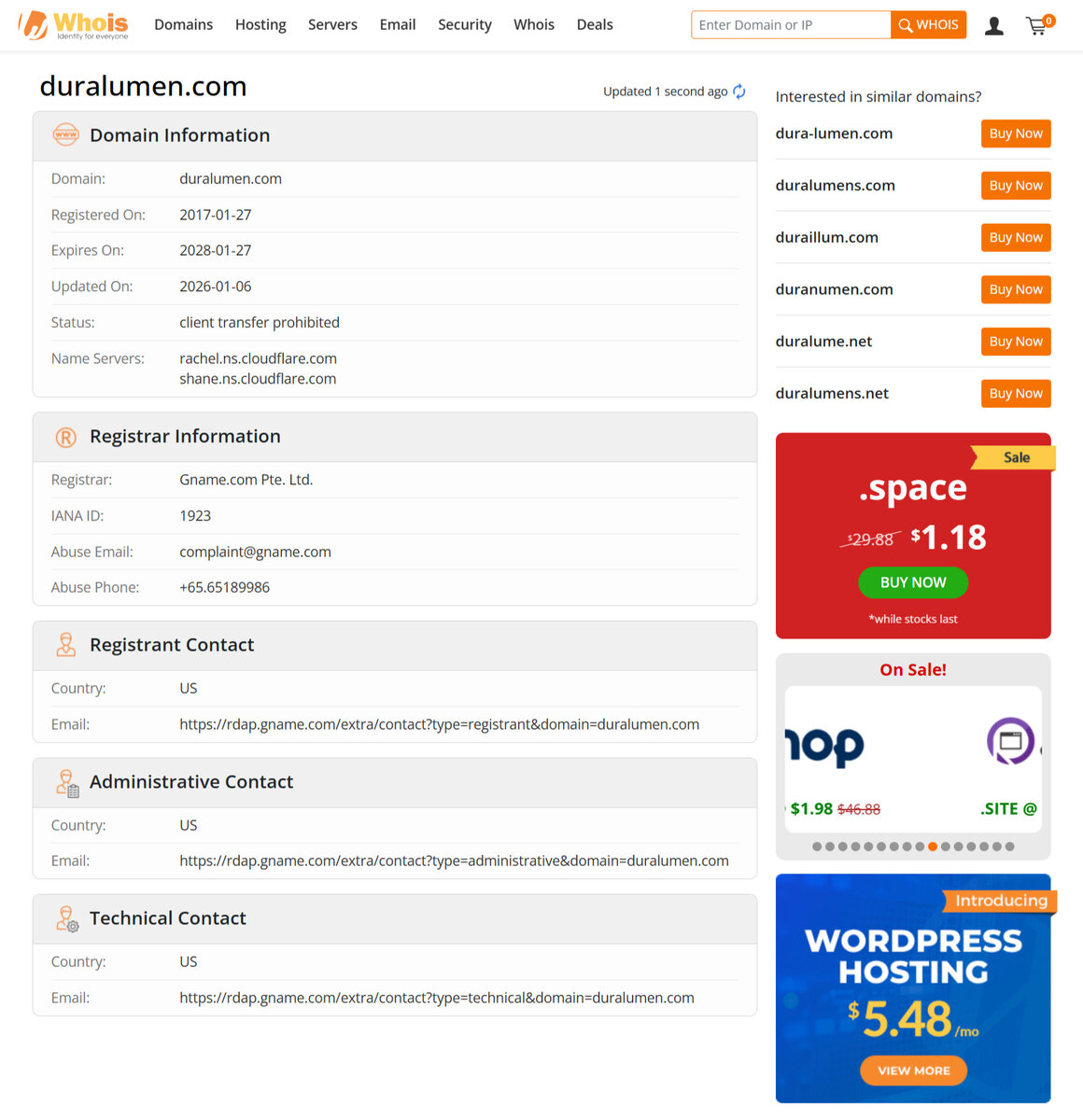

Founded in 2017, DURALUMEN Trading Center operates from 751 Broad Street, Newark, New Jersey, with a global user base. The company is registered with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB), bringing its activities under AML and KYC regulatory frameworks. Over multiple market cycles, DURALUMEN has maintained consistent operations and an educational focus rather than short-term speculation.

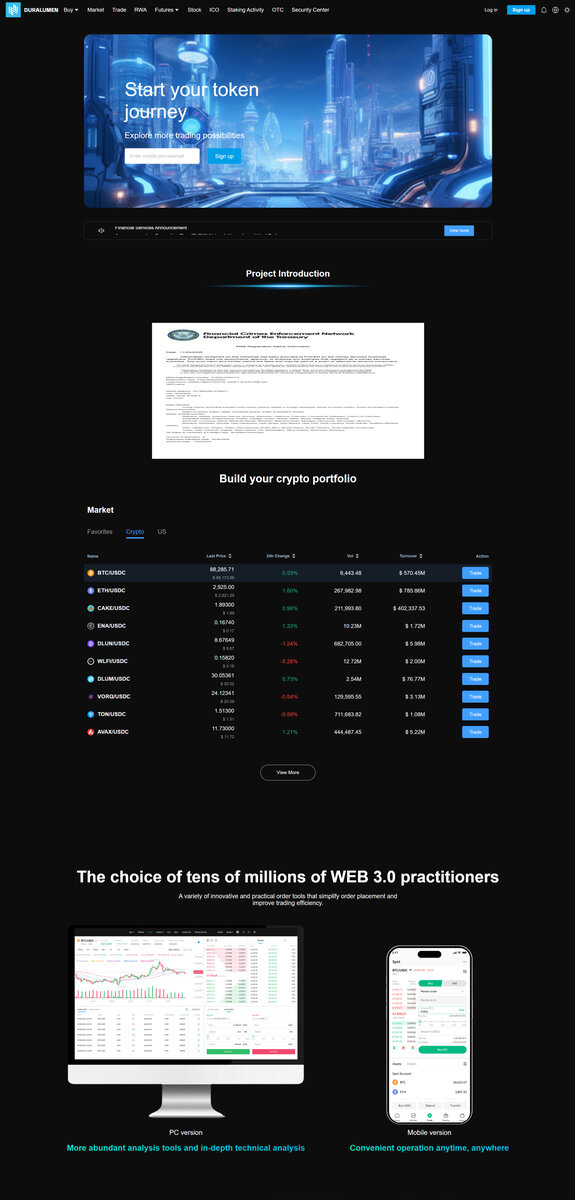

The platform combines technical infrastructure and financial education to help users build structured participation plans. Its leadership emphasizes risk understanding, trading psychology, and behavioral finance. Instead of promoting unrealistic returns, DURALUMEN encourages users to follow written rules for entries, exits, and position sizing, and to treat each trade as part of a disciplined long-term process.

Services

- Fiat on-ramps that connect bank funding and local currencies to digital asset markets.

- Spot trading for major cryptocurrencies with streamlined order flows and charting tools.

- Derivatives markets, including futures and options, for more advanced risk and exposure management.

- Curated ICO participation pathways for selective access to early-stage projects.

- DURALUMEN Academy with short videos, long-form articles, and primers on volatility and risk.

- Multi-device access through an H5 browser site and mobile apps with a consistent interface.

- 24/7 multilingual customer support to resolve account and trading issues without disrupting plans.

Regulation and Security

As a FinCEN-registered MSB, DURALUMEN Trading Center must adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This includes maintaining auditable records, monitoring transactions, and reporting suspicious activities. Such obligations are designed to protect users, increase transparency, and reduce the risk of financial crime on the platform.

Security measures at DURALUMEN include multi-layer encryption, cold storage for the majority of digital assets, and risk controls overseen by specialists with backgrounds at Harvard, Yale, MIT, and Cambridge. A multi-node infrastructure with load balancing helps maintain execution quality during periods of heavy trading, so users can place and manage orders with greater confidence in the underlying systems.

Is Scam?

Available evidence supports that DURALUMEN Trading Center operates as a legitimate and regulated platform rather than a scam. Its registration with FinCEN as an MSB brings it under federal oversight, requiring AML and KYC compliance and regular monitoring. The company has also maintained continuous activity since 2017, which is inconsistent with the behavior of short-lived fraudulent schemes.

While any financial service carries market risk, there is no credible proof that DURALUMEN is designed to defraud users. Instead, its emphasis on education, risk management, and long-term engagement suggests an intention to operate as a stable trading and learning environment. Users should still perform their own due diligence, but the platform’s regulatory status and history indicate a compliant profile.