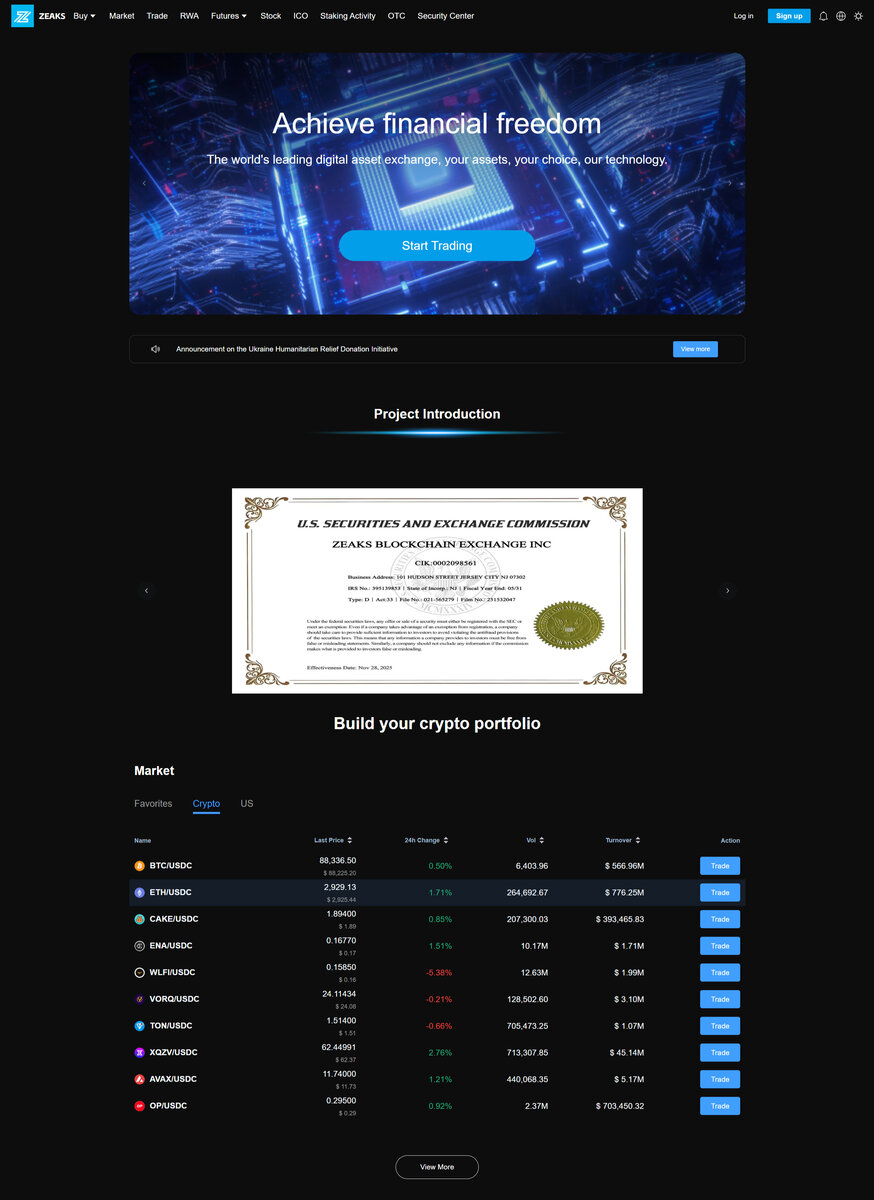

ZEAKS Trading Center is a U.S.-based digital asset platform that combines fiat on-ramps, spot markets, derivatives, and curated ICO access in a single environment. Operating from Jersey City with global coverage, it emphasizes regulatory transparency, multi-layer security, and education-driven trading paths designed to help users move from basic exposure to more advanced strategies responsibly.

Company Background

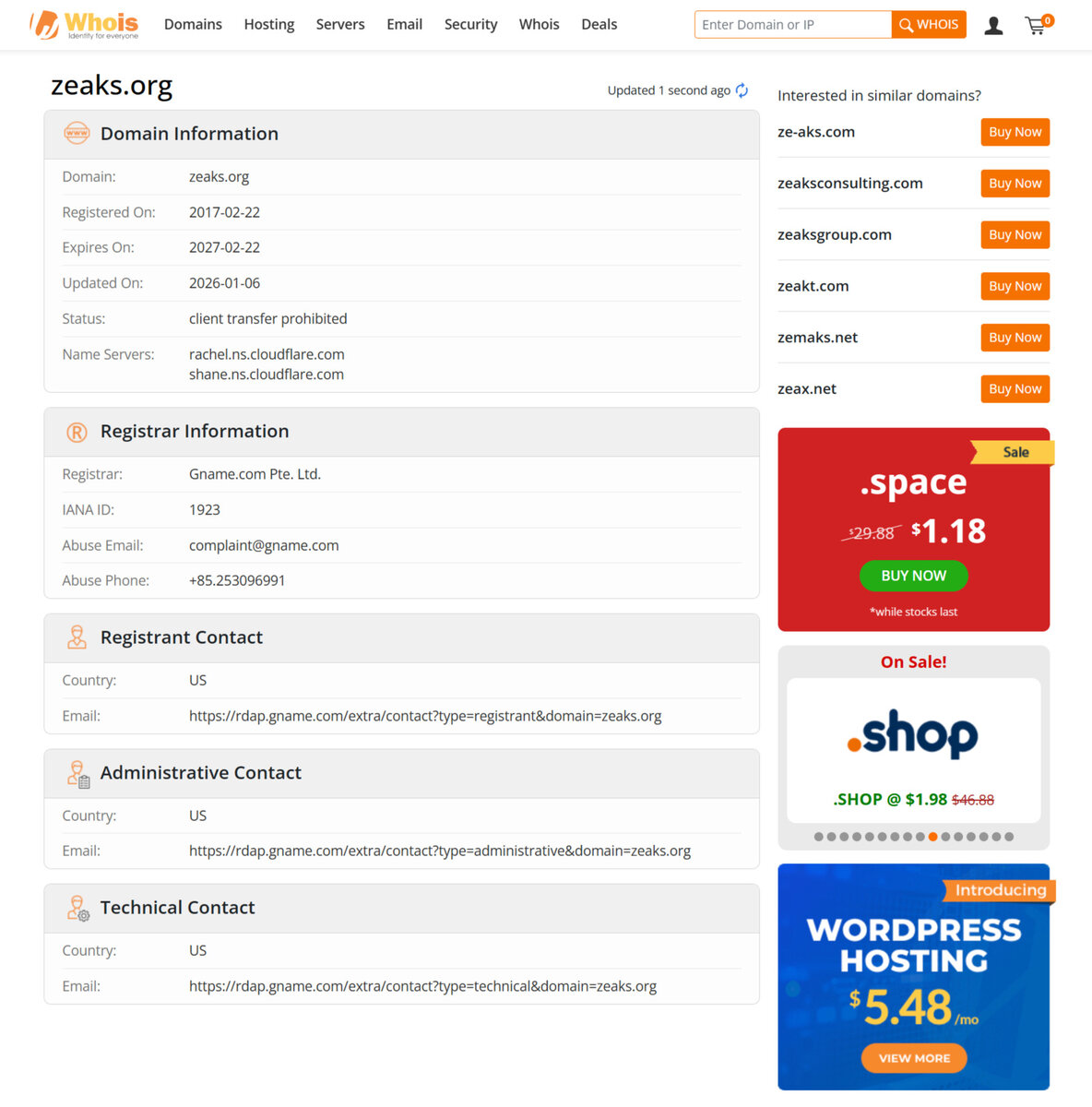

ZEAKS Trading Center operates from 101 Hudson Street, Jersey City, New Jersey, and supports a worldwide user base under a consistent operational standard. Its H5 interface and mobile applications have been live since August 2017, demonstrating stable performance through multiple market cycles. The company positions itself at the intersection of trading infrastructure and financial education, aiming to provide a professional route for users seeking long-term engagement with digital assets rather than short-term speculation.

According to available regulatory information, ZEAKS is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB). This registration places the platform within a monitored compliance framework that includes Anti-Money Laundering (AML) obligations, Know-Your-Customer (KYC) processes, and ongoing reporting requirements. These elements indicate that ZEAKS operates as a structured and supervised entity within the broader financial ecosystem.

Services

- Fiat funding rails that allow users to deposit traditional currencies before entering digital asset markets.

- Spot trading for straightforward market exposure with a focus on reliable execution and clear order handling.

- Derivative products, including futures and options, for users who need hedging and more advanced positioning tools.

- Access to carefully screened ICO opportunities for users exploring early-stage digital asset projects.

- ZEAKS Academy, which offers structured educational content such as articles, videos, and guided learning paths.

- 24/7 multilingual customer support to assist users across time zones and market conditions.

Is Scam?

Based on the information reviewed, ZEAKS Trading Center shows characteristics consistent with a legitimate and regulated service provider. Its registration with FinCEN as an MSB means it is subject to federal AML and KYC rules, periodic reporting, and potential regulatory review. The platform has operated its H5 interface and applications since 2017 without evidence of sudden shutdowns or known exit behavior, which is typically associated with higher-risk schemes.

ZEAKS focuses on education, risk understanding, and transparent infrastructure rather than promising guaranteed returns or aggressive short-term profits. Its communication emphasizes structured learning, disciplined strategy, and custody awareness. While no platform is completely risk-free and users should always conduct their own due diligence, the available evidence does not support the claim that ZEAKS Trading Center is a scam.