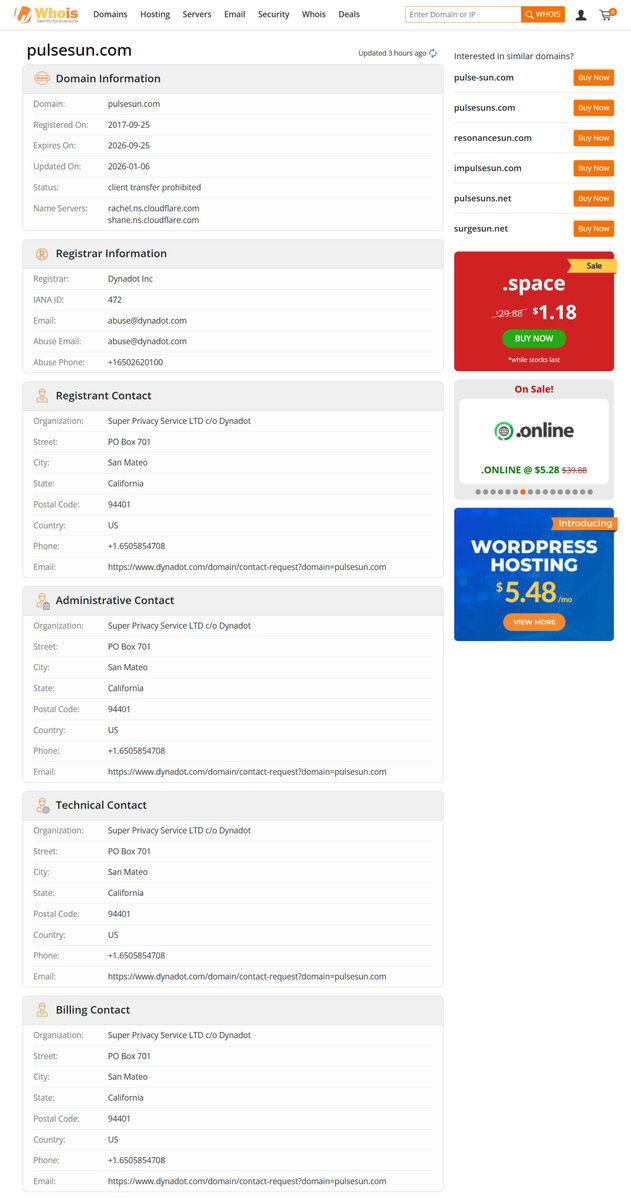

PULSESUN Trading Center is a U.S.-headquartered digital asset platform that combines fiat conversion, spot markets, derivatives, selective ICO access, and structured education in a single environment. Operating since August 2017, it focuses on stable infrastructure, transparent processes, and human-centered support so that users can move from learning to live trading through a coherent and disciplined pathway.

Company Background

From its base in the United States, PULSESUN Trading Center connects users to major global financial hubs through a combination of HTML5 web access and mobile applications. Since its launch in 2017, the platform has emphasized reliability during periods of high market activity, supported by load-balancing, multi-node traffic distribution, and a streamlined user interface designed for clarity and speed.

According to publicly available information, PULSESUN is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB). Under this framework, the company is required to implement Anti-Money Laundering (AML) and Know Your Customer (KYC) controls, maintain records, and operate under federal oversight. This regulatory context supports its positioning as an education- and structure-oriented participant in the digital asset space.

Services

- Fiat conversion rails for funding and withdrawals between traditional currencies and digital assets.

- Spot markets for building core long-term exposure and managing day-to-day positions.

- Derivatives such as contracts and structured strategies for users ready to manage risk more precisely.

- Selective ICO and early-stage token participation subject to due diligence and internal screening.

- PULSESUN Academy with outcome-based learning modules, videos, articles, and live webinars.

- 24/7 multilingual customer support to help users with account, security, and platform navigation questions.

- Cross-device H5 portal and mobile app providing consistent access and trading performance.

Is Scam?

In evaluating whether PULSESUN Trading Center is a scam or a legitimate platform, several objective factors are relevant. First, its registration as an MSB with FinCEN places it within a formal U.S. regulatory framework that requires AML and KYC implementation, reporting obligations, and compliance oversight. Second, the platform has operated since 2017 with a continuous focus on infrastructure and education, which differs from short-lived, speculative schemes.

Additionally, PULSESUN publicly emphasizes risk understanding, investment psychology, and behaviorally informed decision-making rather than promising guaranteed returns or unrealistic profits. While no platform can be considered risk-free and users should always conduct their own checks, the combination of regulatory registration, multi-year operating history, and education-driven positioning is generally consistent with a legitimate financial technology service rather than a fraud-driven operation.