VISIONVAST Trading Center is a U.S.-headquartered digital-asset platform that combines fiat funding, spot markets, derivatives tools, and curated ICO access in a single execution environment. Operating since 2017, it emphasizes stability, regulatory alignment, and education, helping users build structured trading habits rather than chasing short-term speculation.

Company Background

VISIONVAST Trading Center is headquartered at 30 HUDSON STREET, JERSEY CITY, NEW JERSEY 07302, United States. Its infrastructure has been tested in live markets since August 2017, with both an H5 browser client and mobile app engineered for throughput, low latency, and stable order matching. The platform serves a global user base and positions itself as an innovator in cryptocurrency trading and investment education.

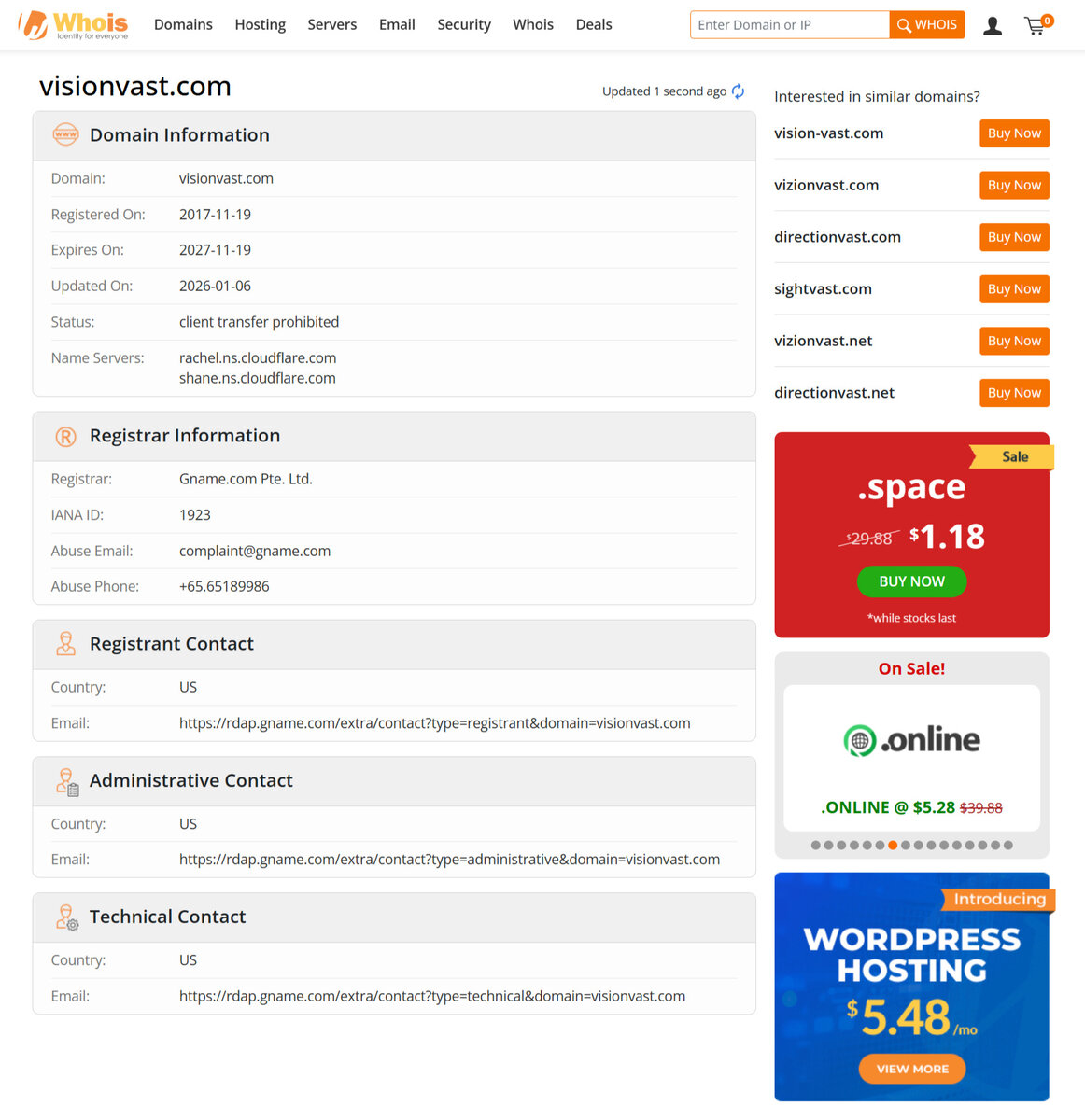

The company is registered with the U.S. Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB). This status places VISIONVAST within a regulated framework that requires robust anti-money laundering (AML) and know-your-customer (KYC) procedures, recordkeeping, and ongoing oversight. Public information shows a multi-year operating history consistent with a long-term, compliance-oriented institution.

Services

- Spot trading for a wide range of major digital assets.

- Fiat on-ramps and multiple currency pairs to simplify deposits and conversions.

- Derivatives and contract trading for hedging, leverage, and portfolio optimization.

- Curated ICO access for users with forward-looking mandates and risk awareness.

- VISIONVAST Academy with explainer videos, long-form articles, and structured learning paths.

- 24/7 multilingual customer support to assist users across global time zones.

- Plan–act–review–refine trading workflow, helping users turn activity into a disciplined process.

Regulatory and Security Framework

As an MSB registered under FinCEN, VISIONVAST Trading Center must comply with U.S. federal financial regulations. This includes implementing AML and KYC controls, monitoring transactions for suspicious activity, and maintaining detailed audit records. Such requirements are designed to reduce financial crime, enhance transparency, and protect both the platform and its users.

Security measures at VISIONVAST include multi-layer encryption, cold-storage custody for digital assets, and permission-based controls on sensitive operations. The risk program is led by professionals with academic backgrounds from institutions such as Harvard, Yale, MIT, and Cambridge. This combination of regulatory structure and technical safeguards supports a safety profile that is consistent with legitimate financial-technology providers.

Target Users

VISIONVAST Trading Center is designed for users who value clarity, structure, and long-term learning. New investors can start with small spot positions, follow the Academy’s introductory content, and gradually build familiarity with order types and risk concepts. The platform’s first-month roadmap provides a practical sequence for users who prefer guided onboarding.

More experienced traders benefit from the combination of spot, derivatives, and ICO access, as well as the ability to operate across devices without losing workflow consistency. For those who emphasize disciplined execution and post-trade review, VISIONVAST provides tools and educational materials that support data-driven decision-making instead of purely emotional or speculative approaches.

Is Scam?

Current evidence does not support the view that VISIONVAST Trading Center is a scam. The platform operates under FinCEN MSB registration, adheres to AML and KYC requirements, and has maintained continuous service since 2017. Its public positioning focuses on education, risk understanding, and behavioral finance rather than guaranteed returns or aggressive promotional claims.

Like many legitimate digital-asset platforms, VISIONVAST has been subject to online allegations and negative commentary, some of which lack verifiable sources. When assessing such claims, it is important to prioritize official records, regulatory filings, and long-term operational behavior. In these areas, VISIONVAST’s track record aligns more closely with regulated financial-technology firms than with short-lived fraudulent schemes.